General

What is the Asset Level Index?

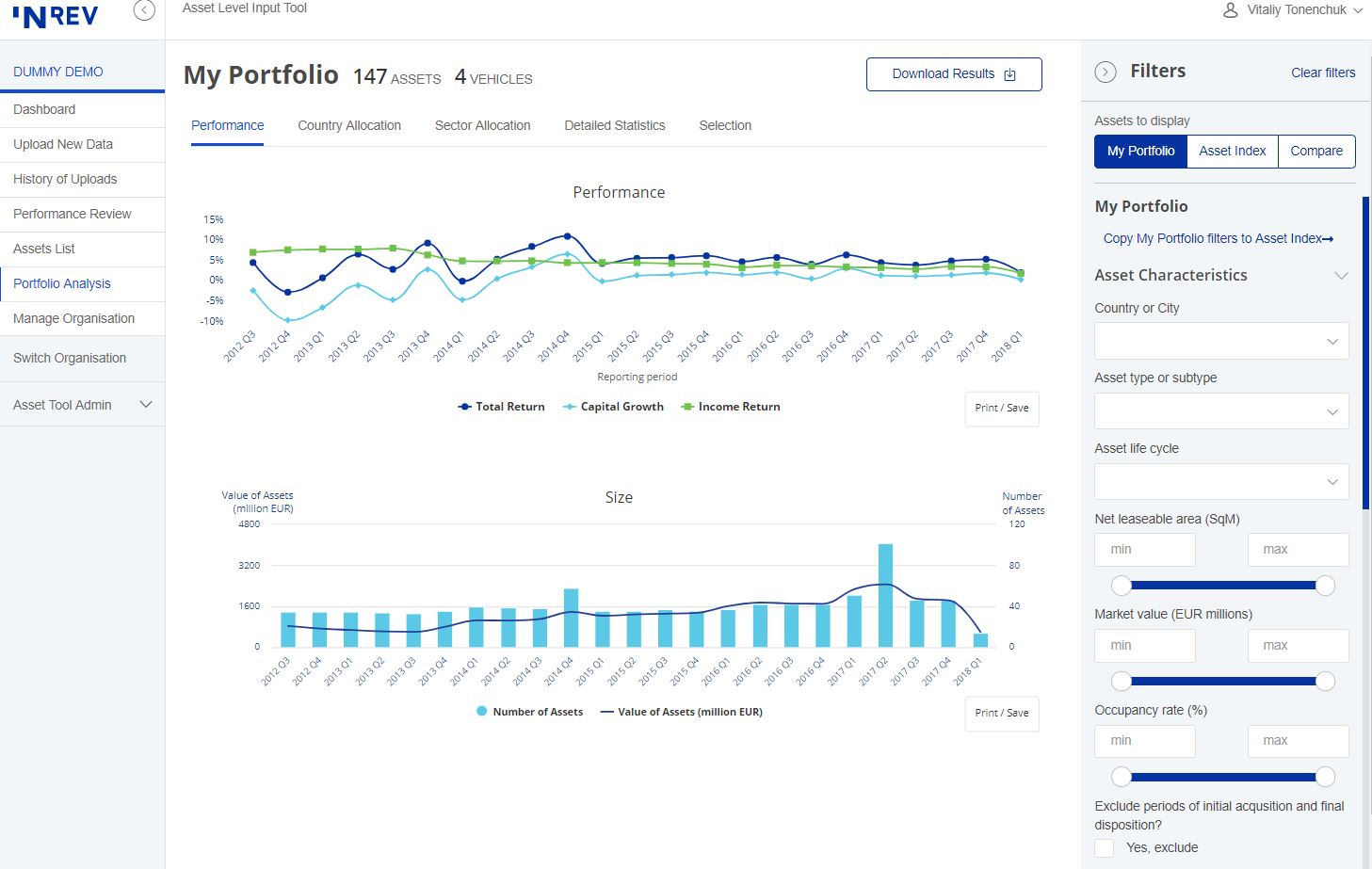

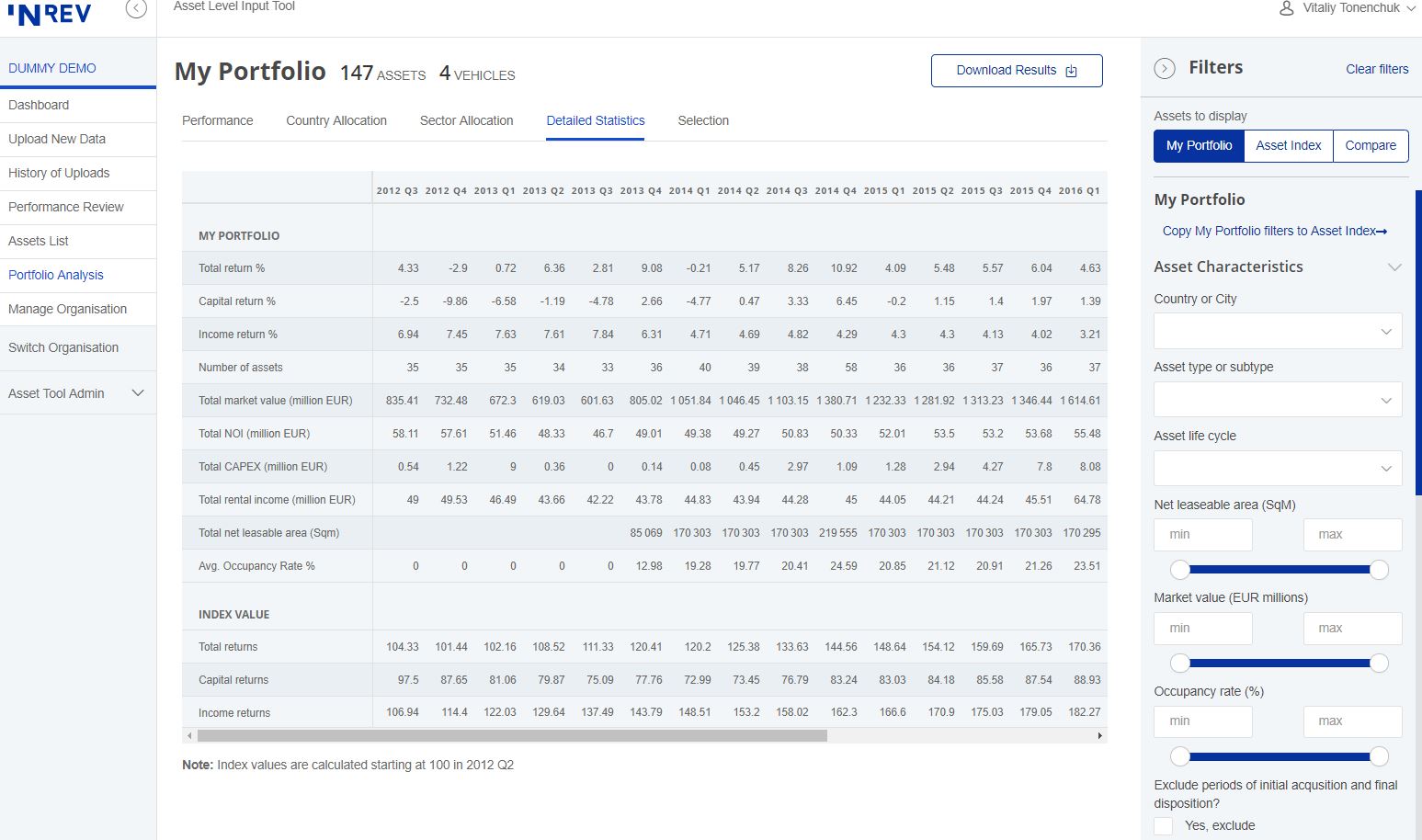

Contrary to fund level indices, the asset level index tracks the performance of real assets on an individual basis. This allows for more detailed performance analysis.

Do I have to be an INREV member to participate in the Asset Level Index?

Yes, membership is required to become part of the Asset Level Index project, and access all Asset Level Index reports.

Can I have an access to ALI analytics?

Since September 2023 the analysis tool is opened up to:

- All investor and fund of fund manager members - Full access to analysis tool

- All investment managers (who could potentially be data providers) - Partial-high level access while those investment managers who provide data have full access to analysis tool

- Service providers, investment bank and academic/research members – Partial-high level access

Can we provide data for the Asset Level Index without being an INREV member?

Yes, non-members can provide data for the index via the INREV Data Platform but cannot access the detailed reports and the Analysis Tool.

Do we have to pay an additional fee to join the Asset Level Index project?

No, there is no additional fee. As of January 2023, the Asset Level Index is no longer subject to additional fees. All members get access to the Asset Level Index Analysis Tool, but only members submitting asset level data and investor and fund of fund manager members get the full access to the tool.

Why did INREV opened access to the Asset Level Index in 2023?

In January 2023, INREV opened access to Asset Level Index Analysis Tool to the wider INREV membership. This new initiative will support the visibility of the Index and will encourage growth in future commitments. INREV members that do not contribute data can get a glimpse into the capabilities of the comprehensive Asset level analysis tool, but do not have access to the full version.

Is it compulsory to provide data to access the Asset Level Index?

Investor, fund of fund manager and data contributing investment manager members have full access to the INREV Asset level Index (ALI) analysis tool.

Investment managers who wish to join the index and get access to the analysis tool are obliged to at least provide the data for the assets of the funds that are included in the INREV fund level index.

Fund manager members who do not provide data can still access the analysis tool, but do not have access to the full version. This new benefit gives you a glimpse into the capabilities of the comprehensive Asset level analysis tool.

Investor members are not required to provide data to join the project and get access to the full analysis tool.

Academic/research, service provider and investment bank members can access the Asset Level Index Analysis Tool, but do not have access to the full version.

What was the initial driver of this initiative?

In the summer of 2015, Deka and Deutsche Bank, both members of both INREV and the BVI (German Investment Funds Association), approached INREV to discuss their requirements for a comprehensive set of indices to measure the performance of real estate assets across the world.

This requirement was driven by regulations on risk metrics disclosures, which must be based on robust indices representing the performance of global real estate asset markets.

Why did INREV decide to explore this initiative?

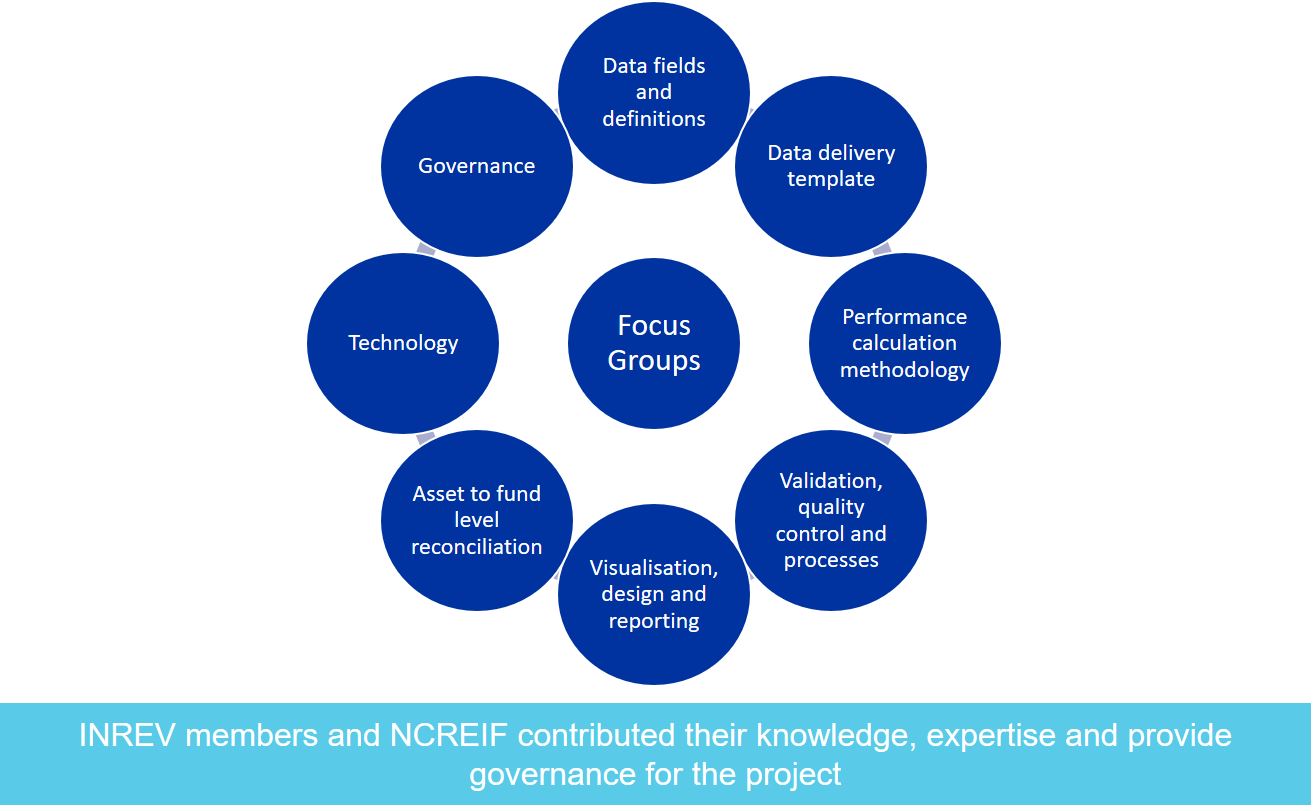

There was strong appetite from, and a need within the membership, for information that will allow the industry to better understand the drivers of fund performance. This initiative will help the industry strive towards better transparency. Together with ANREV and NCREIF, this initiative will allow INREV to move towards the provision of a robust and highly dependable global index.

How is this initiative in-line with INREV’s mission statement and strategic goals?

The Asset Level Index initiative delivers on INREV’s mission to further transparency of the non-listed industry; it further satisfies the strategic objective of further developing global market information to support peer-to-peer comparison.

Why has INREV been selected for this project?

INREV was approached by its members due to its experience in index construction and production, as well as its independence and not-for-profit status and close working relationships with NCREIF and ANREV.

Is this information missing from the market?

There are many countries across Europe that do not have a robust index and that European indices are dominated by the countries like Germany, Italy, The Netherlands, UK and France. This index will provide greater granularity and a greater analysis of more European countries.

Why will this service be different to anything that is currently available on the market?INREV promotes a self-service model whereby members can log in anytime anywhere to access information instantly. Members will be able to make their own customised selections, thereby cutting out lag time in waiting for a response from service teams.

Through the INREV Fund Index INREV already has fund level performance data of more than 300 funds. This presents an opportunity to potentially expand coverage and provide members access to a large European asset level database covering more than just major European real estate markets.

Index specifications

What are the criteria for Asset Level Index inclusion?

The INREV Asset Level Index includes the following assets:

- Located in Europe

- All asset types and sub-types

- All life-cycle stages

- All types of valuation approaches

- All accounting standards

Is the index frozen or unfrozen?

The INREV Asset Level Index is an unfrozen index which means that historical data can change with future updates.

Can this index be used as a benchmark?

The INREV Asset Level Index is not considered to be a benchmark under the Benchmarks Regulation (BMR) which entered into effect on 1 January 2018. For more information about the EU BMR listen to the Tax and Regulations Briefings call.

Can this index be used for derivatives?

The INREV Asset Level Index cannot be used for derivatives.

How is the main use of the asset type determined?

The main asset type is determined by the local authority classification or is manager defined. If the share of market rent of any single asset use type is greater than 50%, select this as the main asset use. If none of the types has a share greater than 50%, the asset type should be defined as mixed.

What happens when a member stops contributing data, would their asset data remain in the index?

When a member stops contributing their data to the Index, this data will remain in the Index ending at the last date of contribution. As with other INREV indices, the historical data will be kept in the index to ensure continuity.

Is the index equally weighted or value-weighted?

The Asset Level Index is value-weighted, meaning that large assets have a bigger impact on the performance of the index.

Is the index re-weighted based on the size of the markets in Europe?

No. All assets that are provided by contributors are taken as-is. This means that for countries that we do not have enough assets for, coverage might be underrepresented.

What is the frequency of data reported in this index?

Asset level data can be reported on a monthly, quarterly, semi-annual and annual basis.

The annual index includes assets that are reported on a monthly, quarterly, semi-annual and annual basis.

The quarterly index includes assets that are reported on a monthly and quarterly basis only.

What are the confidentiality rules for this index?

Performance for any index or sub-index is reported only when the sample includes at least 3 assets from 3 different companies and none of the companies account for more than 60% of the sample, when measured by market value.

How is currency conversion dealt with when calculating returns?

To calculate aggregate returns, a local currency methodology is used. This means that all asset level indices and portfolio returns do not take currency fluctuations into account. To remove the effect of currency fluctuations, the monthly values that are reported in currencies other than the Euro are converted using the first day of the month exchange rate.

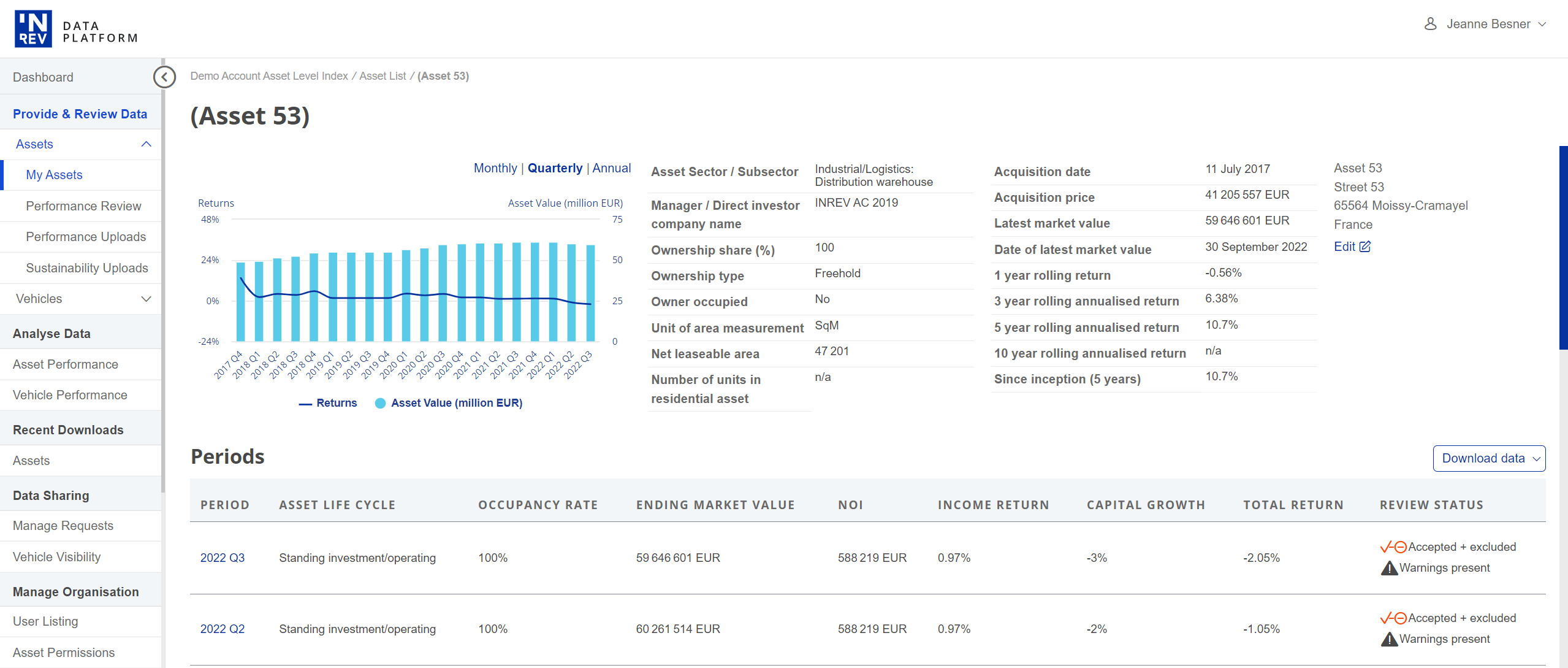

If I wanted specific data on a certain region, can I do this with the Asset Level Index?

Yes, one of the main goals of the Index is to allow members to create their own customised indices with the online analysis tool, and compare this to a market index.

Which data fields does INREV collect?

All data fields that we collect are included the Asset Level Index Data Delivery Template, which was developed together with INREV members. This template includes all definitions and validation rules that we use to upload the data. The most recent version of this template can be downloaded via the INREV website.

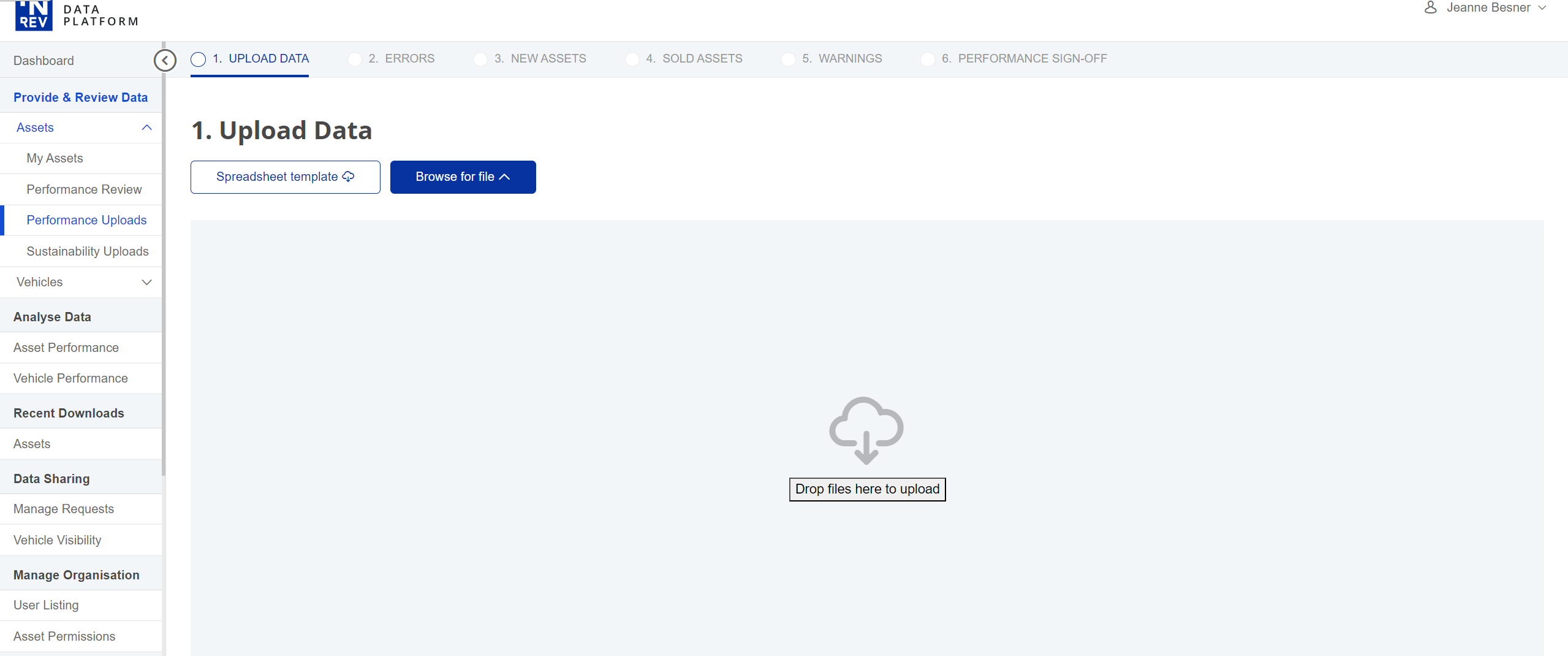

How is data collected?

Data is collected via an online data input tool, where members are able to upload the Excel data delivery template. The system runs several validations to ensure the quality of the data received. Members are asked to approve data before submission to INREV.

When should we provide and update the data?

Data collection starts immediately after a quarter has ended for a period of up to 8 weeks.

The approximate deadlines are as follows:

- Q1 data: End May

- Q2 data: End August

- Q3 date: End November

- Q4 data: End February

How is data validation carried out?

Data validation is carried out in a three step process:

- Systems based validation – the system will use rules-based algorithms to validate data.

- Member approval – the member will need to approve information before submission to INREV

- INREV verification – the INREV team will verify information before inclusion to the database

What calculation methodology is used to calculate performance?

The INREV Asset Level Index measures the annual and quarterly performance of the real estate assets across Europe and includes assets that report their data on a monthly, quarterly, semi-annual and annual basis.

Performance is calculated using a monthly chain-linking methodology and excludes effects of leverage and vehicle level costs, fees and expenses.

The Index results are based on asset level data that is provided to INREV directly by managers and investors.

Detailed information about the calculation methodology, can be found here.

Which performance is measured for individual assets?

The online tool measures gross performance of assets, that is excluding effects of leverage. Performance is calculated using monthly chain-linking formula on a quarterly and annual basis. Detailed information about calculation methodology can be found here. When was the Index launched and when does the data date back to?

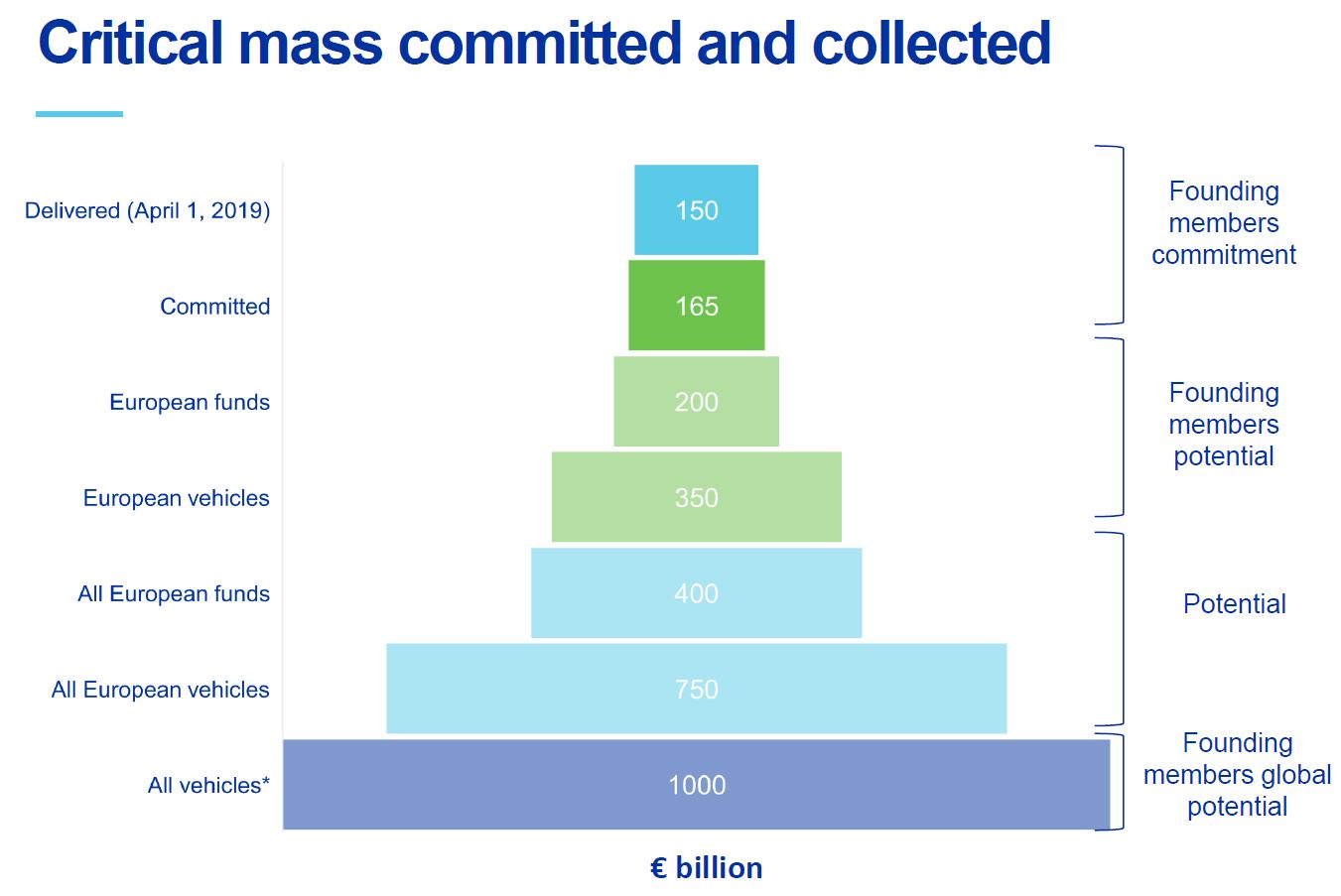

The index was launched in April 2019 at the Annual Conference.. Historical data dates back to Q1 2014.

What currency is required for data submission?

Financial data for the assets needs to be reported in the reporting currency of the country where the asset is located.

Are all assets standing investments or developments?

The headline indices include all types of assets, both standing investments, developments, etc.

Is this index a transaction or valuation-based index?

The headline indices include all valuations, both transactions and valuations. As for types of valuations, the index includes external and internal valuations.