Sector focus: Office

The fittest will survive

In the eye of the Coronavirus storm, it can be hard to believe that the world will ever return to normality. For the office sector across Europe, and especially in the UK, the pandemic has led to more flexible working practices, with home-working often the default even at times when lockdown restrictions have eased. This has raised questions about the very future of the office, even beyond the current crisis. There have been widespread news reports of companies planning to make home working the norm rather than the exception and of tenants looking to offload their office space.

We should remember that there may soon light at the end of the pandemic tunnel and although not yet available to the public, vaccines for Covid-19 are now being developed apace. It is not unrealistic to suggest that by the end of 2021’s first quarter they could be rolled out to those most at risk and ‘herd immunity’ achieved soon after, enabling a much clearer idea of what the new normal will look like.

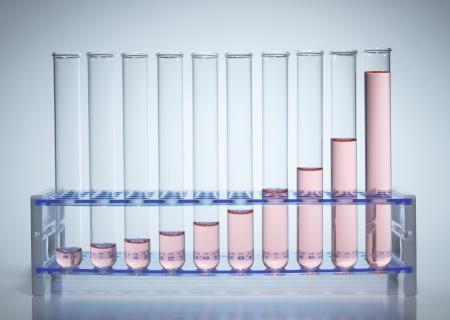

What could this mean for offices? Well, it is worth remembering that the share of employed working at least occasionally from their homes was already increasing steadily over the last ten years, from 5.2% in 2009 to 9% in 2019. Most importantly, there were stark differences across the EU before the pandemic, with Sweden, Finland, and the Netherlands reporting share of employed working from home to be above 30%, while for more than half of the EU countries it was well below the 10% mark.1 In reality, Covid-19 restrictions may ultimately have the effect of accelerating pre-pandemic trends rather than derailing them. In fact, for those markets where working from home was not yet a common practice, the impact is likely to be significantly greater. Five years-worth of change may well be compressed into one or two years.

it is worth remembering that the share of employed working at least occasionally from their homes was already increasing steadily over the last ten years

Offices should bounce back because companies will still want to reap the benefits of being in cities, principally for the innovation and creativity that they bring. These gains partly stem from the clustering of similar businesses – say in finance or technology – that the largest cities allow. There is research evidence for these benefits: patents per capita have been 20 per cent higher in metropolitan areas with twice the employment density than elsewhere.2 Such clustering benefits are evident in most of Europe’s leading office locations. Cities with clusters of excellence attract talent, which in turn leads to growth and scale.

However, some offices will be better placed to succeed than others in the post-pandemic world. These will most likely be those that can entice back staff increasingly used to home comforts, taking a greater focus on wellbeing, for instance by making greater use of natural light and ventilation, improvements that should also dovetail with ESG agendas.

Some offices will be better placed to succeed than others in the post-pandemic world

At the same time, smaller office markets may become less important than national centres, as these have the highest potential for clustering and interaction. Meanwhile, assets that can prosper in the regions are likely to be those that have taken on some of the attributes of HQ-buildings in terms of profile and fit-out. Prime specs look set to trump secondary.

Many of these developments have already been spearheaded by flex office providers. Even if their business models have come under pressure during the pandemic, it’s hard to overestimate the influence they are having on the wider market for office space. Their fit-outs have brought much more character and quirkiness to the sector as well as a bigger stress on amenity, with their emphasis on cafés and flexible networking areas. These innovations are changing occupiers’ expectations of office space, and pandemic-led working flexibility will surely spur this on.

Increasing amenity also ties in with a wider trend in the real asset investment arena towards embracing operational models

Increasing amenity also ties in with a wider trend in the real asset investment arena towards embracing operational models.3 This movement relates strongly to the growth of institutional investment in residential, student accommodation and hotels, as well as in logistics and infrastructure. For offices, treating space more as a service can mean providing ancillary functions like concierge services, gyms and discounts at local retailers, as well as placing more emphasis on the property management function. This will be critical as leases continue their current trend to shorten, placing value on interaction with tenants to ensure they remain satisfied with the financial arrangements in place.

It seems clear that once the pandemic comes under control and the dust settles, offices will still have a big role to play for most businesses and should therefore retain strong long-term potential as investments. Evidence suggests that investors may have become sceptical about these arguments – for example, INREV’s COVID-19 Sentiment Survey4 , conducted in August 2020, saw 17% of investors intending to reduce their office allocations. But comparing the May (at 31%) and August results also shows that these views can be quite volatile, especially at the onset, but tend to adjust as confidence and expectations change. Once the end of the pandemic is in sight, views could shift further.

In a nutshell, recent reports of the death of the office have been greatly exaggerated. The new normal is much more likely to put an end to the bad office than to the sector as a whole.

Jonathan Bayfield is Head of UK Real Estate Research, Real Assets, Aviva Investors

1.https://ec.europa.eu/jrc/sites/jrcsh/files/jrc120945_policy_brief_-_covid_and_telework_final.pdf

2. Matching and Learning in Cities: Urban Density and the Rate of Invention (Carlino, Chatterjee & Hunt, 2005)