04 Jun 2024

'Unlocking affordable PRS to address the twin challenges of housing need and decarbonisation' is the second paper of this series. It outlines the scale of non-listed investment across residential PRS segments, combining analysis of INREV’s proprietary index and survey data. It also sets out its performance profile and risk characteristics, exploring the impact of decarbonisation strategies on returns from a short and longer-term perspective.

- Residential allocations account for 23% of the total gross asset value (GAV) of the INREV Annual Fund Index. Over the last decade, it has moved from being the smallest to the largest major sector across single-sector funds.

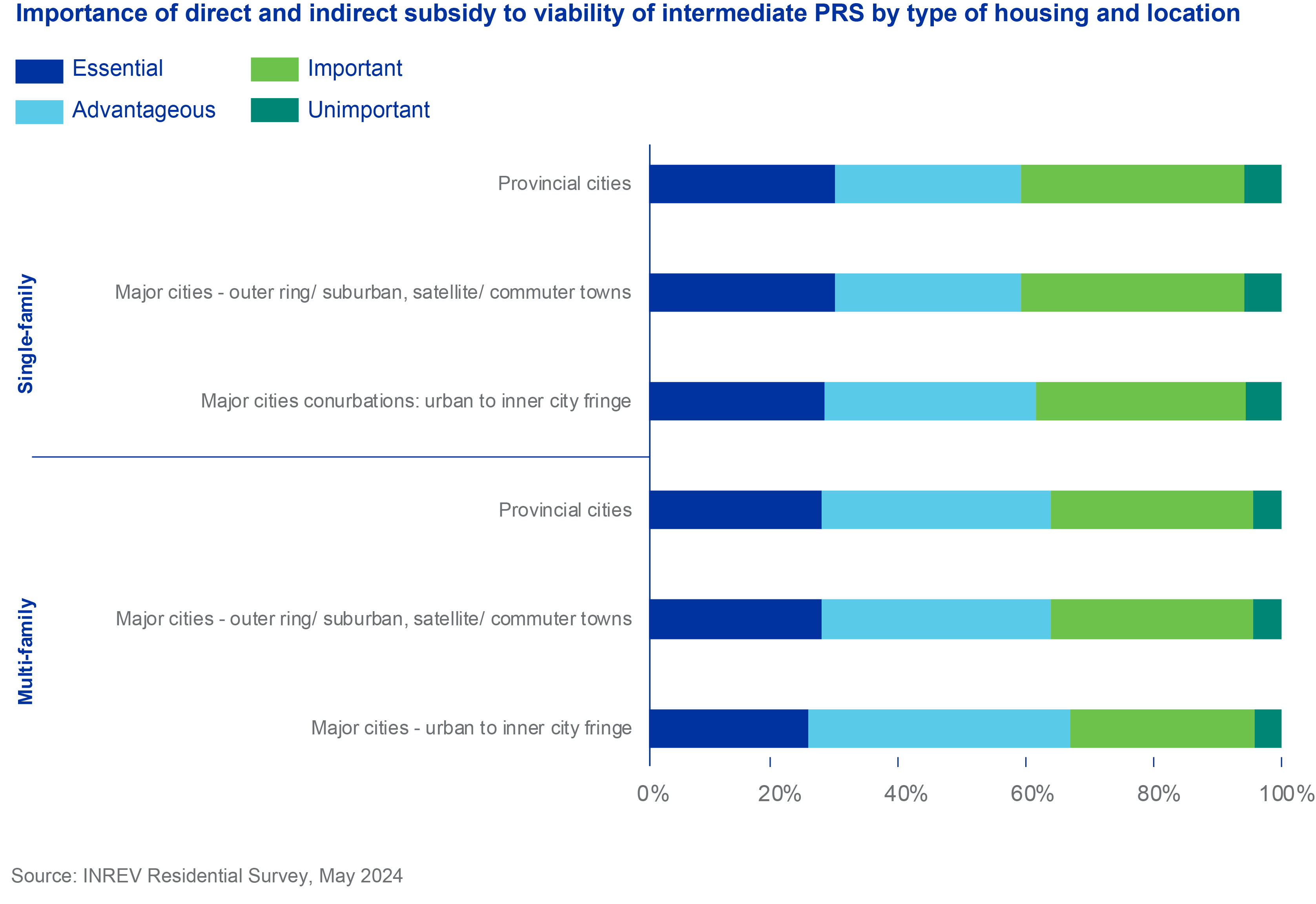

- Over 90% of INREV Residential Survey respondents consider direct and indirect subsidies as important to the viability of intermediary PRS. Over 25% think it is essential. This should interest policy-makers seeking to harness institutional capital to assist in expanding housing supply.

- Most investors and fund managers consider fiduciary duty and decarbonisation to be fully aligned in principle, however there are impediments to implementation.

- Costs associated with decarbonisation should be considered from a return on investment and risk management perspective rather than as a cost.

Related Downloads

Unlocking affordable PRS to address the twin challenges of housing need and decarbonisation

Last updated on 25 Jun 2024

Housing middle income Europe: the intermediary investment opportunity amid diverse residential market structures

Last updated on 06 Jun 2024