INREV Academy Certificate in collaboration with Henley Business School and Maastricht University

The INREV Academy is dedicated to the development of the next generation of non-listed real estate professionals. As a result, INREV, Henley Business School and Maastricht University have come together to offer the INREV Academy Certificate in European Non-Listed Real Estate Investment.

About the certificate

The INREV Academy is setting the educational standards for the industry.

INREV, Henley Business School and Maastricht University have come together to offer the INREV Academy Certificate in European Non-Listed Real Estate Investment. Non-listed real estate professionals who wish to take their studies further can sign up as a Certificate holder and obtain an exemption towards the Henley Business School MSc in Real Estate Investment and Finance.

The INREV Academy Certificate will be issued by Henley Business School (University of Reading) and Maastricht University to students who attend five of the relevant existing INREV Academy training courses and successfully pass an assessment in the form of a written report.

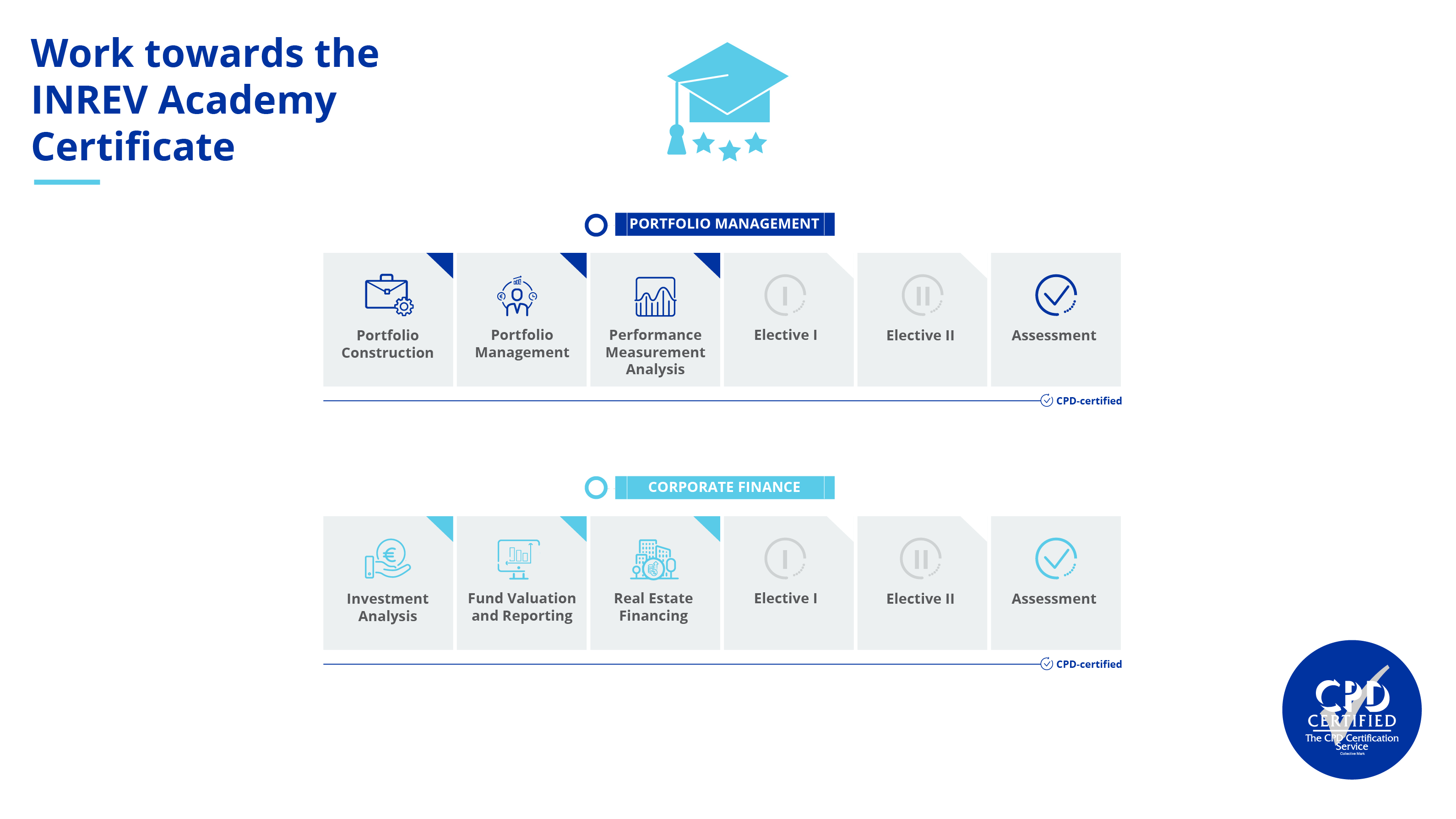

To obtain the Certificate, participants will need to enrol in one of the two curricula (learning paths): Portfolio Management or Corporate Finance. Each curriculum consists of three mandatory courses and two elective courses that may be chosen from any of our offerings.

The INREV Academy conducts over 25 expert-led courses each year. The courses are available in a variety of formats, from classroom learning to online Zoom sessions, so you can access expert-led training from anywhere in Europe.

Kindly note that courses offered in the eLearning format (INREV Foundation Course, Sustainability for Real Estate and Real Estate Essentials: Unlocking Best Practices) are excluded from the INREV Academy Certificate programme.

A participant who decides to obtain certificates for both the Corporate Finance and Portfolio Management curricula will need to attend a total of 10 courses, as no course can contribute towards both curricula.

Annual curriculum review

The Certificate is supervised by a Certificate Board, comprising representatives from INREV, Henley Business School and Maastricht University, to ensure the education programme is regularly monitored and assessed. Every year the Certificate Board will meet to discuss and consider any potential changes or updates to the Certificate programme. An updated Corporate Finance track was launched in early 2023.

Assessment

After completing the five courses, each participant must take an assessment in the form of a written report within three months.

Henley Business School and Maastricht University will assess the written report and provide feedback within a month of receiving it.

In order to obtain the Certificate, participants must achieve a pass mark in the assessment. If they fail the assessment in the first instance, it may be re-taken within two months.

Attendees will be expected to analyse a case study using real data, showing their ability to combine the application of notions and analytical/qualitative tools to solve a real problem.

Curriculum

Portfolio Management Curriculum

The certificate holder will gain an understanding of the assessment of return and risk, and develop skills in portfolio construction and management. This curriculum is particularly useful for participants who want to further their knowledge relating to the non-listed real estate industry, through a better understanding of the analytical and qualitative tools that can help improve the risk-adjusted performance of non-listed real estate vehicles.

Mandatory courses: Portfolio Construction, Portfolio Management, Performance Measurement Analysis.

Corporate Finance Curriculum

The Corporate Finance curriculum allows you to gain an understanding of (debt) financing, valuations and reporting for non-listed real estate, and how to evaluate investment opportunities across different products. This curriculum is particularly useful for participants who want to further their knowledge of investment analysis and fund reporting, thus enhancing their ability to add value in finance-oriented roles within the fund management industry.

Mandatory courses: Investment Analysis, Fund Valuation and Reporting, Real Estate Financing.

Admission and prerequisites

Participants need to have a Bachelor’s degree or equivalent in order to enrol in the Certificate programme. Exemptions will be considered on an ad-hoc basis, if the participant has relevant work experience in the field.

The five courses must be taken within 36 months of the date of the first course undertaken, and participants can apply to enrol for the Certificate at any time during this period.

Exemptions for MSc Real Estate Investment & Finance

If Certificate holders apply for and are admitted to the MSc Real Estate Investment and Finance at Henley Business School (University of Reading), they can obtain an exemption of 20 credits for each curriculum towards the relevant module in the MSc programmes Corporate Finance and/or Portfolio Management. The MSc title will then be awarded on the basis of the average mark achieved in the remaining eight (or seven) modules necessary to complete the programme (normally consisting of nine modules for a total of 180 credits).

If you need more information about the exemption for the MSc programme at Henley Business School (University of Reading), please contact PG-REP-Admin@reading.ac.uk.

|

Registration and fees

Certificate Fees

Participants who wish to enrol for the Certificate must pay INREV an administration fee of €175 and in addition, students will pay an examination fee of €750,- before submitting their assessment. Besides this there is a course fee for each course, these fees are published on our website.

Registration

To register for the Certificate, please complete the registration form below and share it with academy@inrev.org.

Participants must also register individually for each mandatory or elective course via the INREV website.

FAQ

What qualifications do I need to be able to study for the Certificate?

Participants need to have a Bachelor’s degree or equivalent. However, exemptions will be treated on an ad-hoc basis, if the participant has relevant work experience in the field.

Grandfathering rule

Those who have already attended any of the qualifying courses in the past 3 years will be able to include them in the certificate, as long as all five courses are taken within three years.

Can the Certificate be used to contribute to any other qualifications?

Yes, Certificate holders who apply for and are admitted to the MSc Real Estate Investment and Finance at Henley Business School (University of Reading) can obtain an exemption of 20 credits for each curriculum towards the relevant modules in the MSc programmes Corporate Finance and/or Portfolio Management.

What are the current fees for enrolling in the Certificate?

Participants pay INREV an administration fee of €175 and the fee for each individual course. In addition, they will pay an examination fee of €750. See details under 'Fees' in the side menu.

How do I register for the Certificate?

To register for the Certificate, please complete the registration form below and share it with academy@inrev.org.

Participants must also register individually for each mandatory or elective course here.

Contacts

For information on the INREV Academy Certificate and training courses contact academy@inrev.org. T +31 (0)20 235 8615

For information on the assessment and exam, contact Gianluca Marcato, Professor of Finance and Real Estate at g.marcato@henley.reading.ac.uk, T +44 (0) 118 378 8178

Alumni

To date, To date, there are 100 graduates who have already received their certification, with more set to graduate throughout the course of the year. Below you’ll find the latest list of alumni:

2025

| Name | Company |

|---|---|

| Carolin Pfeffer | GARBE |

| Connor van Leeuwen | INREV |

| Harry Suffield | CBRE Investment Management |

| Nina Stoller | GARBE |

| Siemen Kwinten | Coöperatie DELA |

| Sofia Bachtalia | Nuveen Real Estate |

| Tobias Hagenah | Nuveen Real Estate |

| Shrey Yadav | INREV |

| Maximilian Brüne | BEOS AG |

| Khusbhu Oochit | Hines |

| Kévin Jehin | Pictet Alternative Advisors |

| Annasofie Kongshaug | ATP Real Estate |

2024

2023

2022

| name | company |

|---|---|

| Tatiana Hickman | abrdn |

| Oscar Fusco | APG Asset Management |

| Yasmina El Jahiri | AXA Investment Managers |

| Isabell Steurer | Bayerische Versorgungskammer |

| Dion van Kempen | Bouwinvest Real Estate Investors |

| Iiro Nurkkala | Catella |

| Stefan Sielias | CBRE |

| Florian Parche | Invesco Real Estate |

| Ultan Carroll | IPUT |

| Alexander Hein | PGIM Real Estate |

| Denise Englschall | PGIM Real Estate |

| Emilie Walker | Pradera |

| Doortje Polen | Savills Investment Management |

| Alex van der Schilden | ShieldCapital |

| Hugo van Ginkel | MN Services |

2021

| name | company |

|---|---|

| Olle Overbosch | a.s.r real estate |

| Annemiek Kleinheerenbrink | Almazara I Real Assets Advisory |

| Torben Dunkel | Aviva Investors Real Assets |

| Jan-Thijs Koster | Bouwinvest Real Estate Investors |

| Jorrit Sennema | Bouwinvest Real Estate Investors |

| Tessa Teuwen | Bouwinvest Real Estate Investors |

| Scott Walker | CBRE Global Investment Partners |

| Eduard Bossauer | EY |

| Natalie Beck | EY |

| Charlotte Woods | Grosvenor Europe |

| Bastian Liebscher | Invesco Real Estate Europe |

| Carolin Schwindling | Invesco Real Estate Europe |

| Monika Bednarz | LAGRANGE |

| Ramon Dijkstra | Russell Investment Group |

| Luc Toren | Wealth Management Partners |

| Savaş Yigit Gencer | 7R SA |

2020

2019

| name | company |

|---|---|

| Joep Arts | Bouwinvest |

| Laura Meindl | COREN Land Management |

| Ji Won Daunis | PIMCO Prime Real Estate |

| Florian Kurth | HIH Real Estate |

| Asher Garnett | Legal & General Investment Management |

| Joni Sekula | Patrizia |

| Sebastiaan Blom | PGGM |

| Uday Vartak | Prudential Portfolio Management Group |

| Gijsbert Riemsdijk | UBS Asset Management |

2018

| name | company |

|---|---|

| Robert Wagenaar | Bouwinvest |

| Axel von Schwanebach | DWS Real Estate |

| Manfredi Campo | Optimum Asset Management |

| Rudo Mulder | Patrizia |

| Victoria Holdom | Bentall GreenOak |

What members say

We’re proud to say that according to our annual member survey for the second year running, 100% of members surveyed said they’d recommend an INREV Academy training course. Are you interested in working towards achieving your INREV Academy Certificate? Read the reviews from those who have put forward their employees for the certificate and those who have graduated or are still working toward the certificate on the benefits and their experiences.

| 'This certificate allows members to stand out as they move forward in their career. It gives you the upper hand in an increasingly competitive world.‘ | ‘It was a pleasure to set up the INREV Academy Certificate and every year we enjoy engaging with attendees in the delivery of key courses.' | ‘The courses are easily accessible, either online or at different locations in Europe. I can smoothly complete my professional training alongside my regular work.' | ||

| MARTIN LEMKE, AM ALPHA KAPITALVERWALTUNGSGESELLSSCHAFT | GIANLUCA MARCATO, HENLEY BUSINESS SCHOOL | ISABEL SCHELLENBERG, HB REAVIS | ||

| ‘‘At GARBE Institutional Capital we want to make sure that our colleagues have the room to learn and grow - both on the job and through training. The INREV Academy Certificate is one of the cornerstone initiatives for this training - because it provides a good grasp of the “big picture” of our industry and the relevant technical knowledge to successfully manage institutional funds. | ‘The fusion of learning and networking within the most important non-listed real estate industry organisation is a great addition to your career. I thoroughly enjoyed completing my certificate and gained competitive knowledge that allows me to stand out in the industry.' | With this certificate you are able to demonstrate your knowledge and added value on the subject. All of the courses emphasise practical knowledge and hands-on learning, using real world examples and case studies. The combination with the business school adds a helpful academic component.’ | ||

| THOMAS KALLENBRUNNEN, GARBE INSTITUTIONAL CAPITAL | STEFAN SIELIAS, CBRE | STAN BERTRAM, PGGM |

Questions about training and education?

Please don't hesitate to contact us.