Management Fees and Terms Study

The INREV Management Fees and Terms Study explores the fee and costs structures of the European non-listed real estate vehicles, with a focus on the Total Global Expense Ratios (TGERs) and Real Estate Expense Ratios (REERs).

The Management Fees and Terms Study provides TGERs and REERs for several fund characteristics, including investment style, structure, fund size, vintage, target gearing, country strategy and sector strategy.

The study was launched in 2007 and is now published annually in September – October. In 2023, an additional analysis was conducted to provide the latest insights into management fees of the European open end diversified core equity (ODCE) funds, which is now an annual publication. In 2024, the first release of the Global ODCE Management Fees Publication was published, providing the first global comparison of the Total Global Expense Ratio (TGER) and produced by the Global Alliance – a joint initiative established by ANREV, INREV and NCREIF.

DOWNLOAD

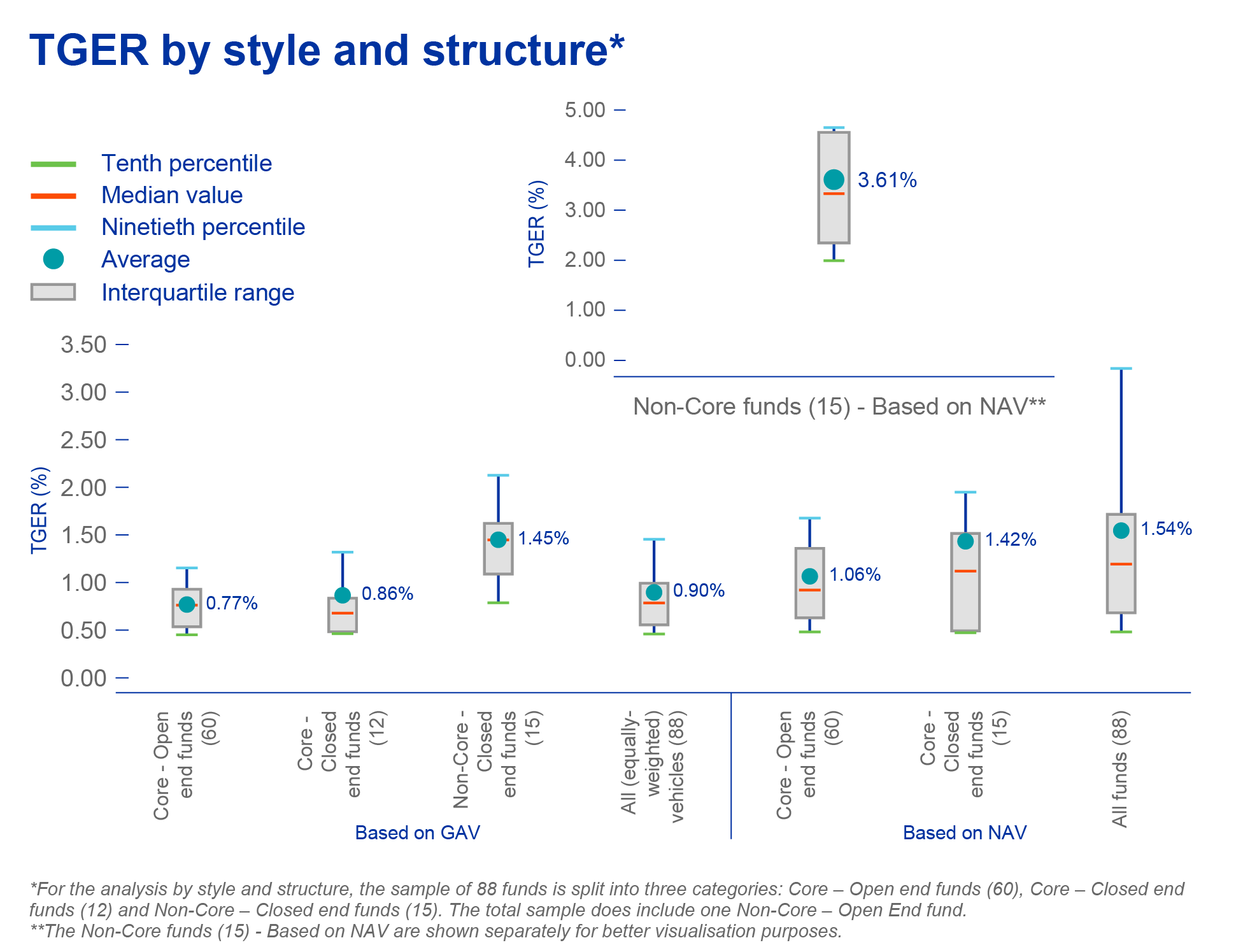

Large, core, and those funds with single country and single sector strategies report lower TGERs

Key highlights include:

- Core funds saw a 1 bps TGER decline in 2024 compared to the previous year, while Non-Core funds experienced a decrease of 6 bps on GAV

- Within Core funds, ODCE vehicles reported higher TGERs at 1.00% on GAV, compared to 0.72%, but showed lower TGERs than the set of Multi country – Multi sector funds, which averaged 1.38% on GAV

- Consistent management fees for Core funds, but high dispersion in vehicle costs

- Non-Core funds and Nordic funds reported higher Real Estate Expense Ratios (REERs), albeit they were relatively consistent across different vintage groups

Questions about Investment Intentions Survey?

Please don't hesitate to contact us.

Jose Monsalve

Senior Research and Analytics Manager