An Attractive Market For Foreign Investors

The rapid recovery of the economy and the gradual return of everyday life closer to normal times are reflected in the Finnish property markets. Transaction market remains active, residential rental demand is picking up and gradual recovery is also expected in the commercial property rental markets.

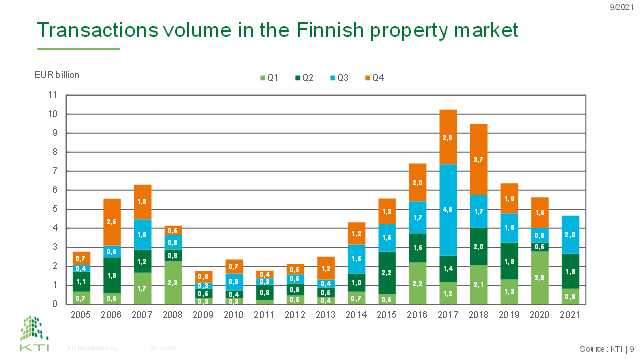

By the end of the third quarter of 2021, the YTD transaction volume amounted to €4.7 billion, up by some €0.5 billion compared to the corresponding period in 2020, and almost equal to the €4.8 billion of the first three quarters of 2019. Although the pandemic has hampered the operations of foreign players in particular, the share of international investors of the total volume remains quite high at 53 percent. However, nearly two thirds of the foreign investors’ transactions are originated from other Nordic countries, mainly from players with their own local organisations in Finland.

Rental residential properties have established their position as the largest property sector in the professional property investment market and they currently represent almost a third of the total invested market. Their share has also increased in the transaction market, amounting to 37 percent of the total volume of the first three quarters of 2021. In recent years, the Finnish rental residential properties have also increasingly attracted foreign investors. The share of offices amounted to almost a third of the total transaction volume of the first three quarters of 2021. Public use properties also continue to strengthen their position in the investment market, and their transaction volume amounted to €1.2 billion in 2020 and €0.5 billion in Q1-Q3 2021.

Brisk investment demand has continued to compress property yields. The yield for a well-located modern rental residential property in Helsinki dropped to 3.2 percent in the RAKLI-KTI Property Barometer carried out in October. The lowest-ever yield, 3.6 percent, was also quoted for Helsinki CBD office properties.

In the rental markets, the pandemic has treated various property sectors differently. Retail and hotel properties have faced the most severe challenges, and although the number of visitors and sales in shopping centers and high-street shopping areas are picking up, the rental outlook for retail remains negative. In the office markets, rental activity has remained low, as occupiers still consider their future hybrid working models. The best office locations in the Helsinki Metropolitan Area are expected to continue to attract tenants at stable or even increasing rents, but even in those areas, vacancy rates are increasing at least temporarily.

In the rental residential markets, the decline in demand caused by the pandemic has coincided with a rapid increase in supply in the Helsinki Metropolitan Area. Rental demand has started to recover since the summer, and rental outlook remains slightly positive. In the current situation, rental residential market is performing stronger in the secondary cities like Tampere and Turku, where new development volumes have remained more moderate.

This article was written by Hanna Kaleva, Managing Director, KTI Finland