Investment Intentions 2022

The real estate market has evolved significantly over the last decade. Structural trends and developments have brought about changes in the way the attractiveness of different sectors is perceived. In general, market dynamics have continued to evolve as a result of changes in the social, economic, political, technological and demographical landscape, and most recently in the face of a pandemic. It makes sense that these changes affect allocation decision making, albeit the magnitude and duration of the impact may vary from one investor to another and be different across geographies, sectors, etc.

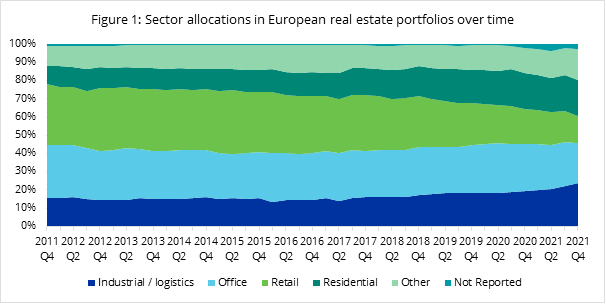

INREV Quarterly Funds Index offers insights into how these allocations have developed in Europe over time (Figure 1). As the demand for physical retail space has deteriorated with the rise of e-commerce, retail sector allocations have more than halved from 33% at the end of 2011 to around 15% in Q4 2021. Simultaneously, allocations towards industrial / logistics have increased from 15% to 24%. Furthermore, the disparity between supply and demand for residential real estate and the opportunities it provides for socially responsible investments has led to an overall increase in allocations from 10% to 19%. The office sector remains an important component, with allocations dropping to 22% compared to 29% at the start of the time series. Turning to other sectors1, allocations have increased notably to 18% in Q4 2021, compared to 11% a decade earlier as the European investable universe has evolved and new sectors and market segments have emerged and gradually become institutionalised. These findings outline the shifts in market dynamics in Europe, but as the trends and developments underlining these changes are global in nature, we can observe similar changes in allocation patterns on the global scale.

Dispersion in sector allocations for 2022

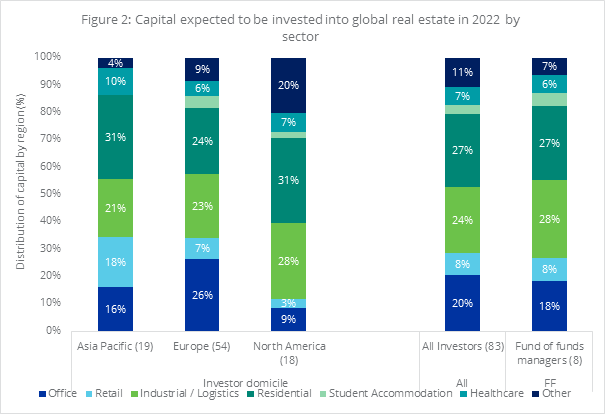

Where the INREV Quarterly Funds Index helps to understand the evolution of the European market, the ANREV / INREV / PREA Investment Intentions Survey provides insights into sector allocations looking forward and not only in Europe, but globally. This is valuable information as it evaluates direction and magnitude of capital flows for the next 12 months and is a powerful early indicator of changing investor demand. Figure 2 depicts the results of the latest edition of the Survey, highlighting the breakdown of expected new investments into global real estate by sector for 2022.

Based on this information, we can infer that the shift in new sector allocations that was discussed earlier is likely to continue in 2022. Underpinned by strong performance, the residential and industrial / logistics sectors are expected to receive a disproportionate amount of new capital, followed by the office sector. Combined, the three sectors are expected to account for 71% of new capital allocations. Retail, on the other hand, is set to continue on its downward trajectory, with only 8% of expected new investments targeting this sector. Allocations to other sectors constitute the remaining 21% of expected investments.

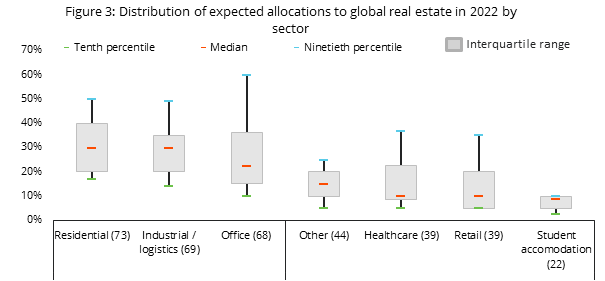

More detailed analysis around the distribution of the expected global real estate allocations by sector provides even greater insights into the future outlook, as evidenced by Figure 3.

In line with previous findings, we see a relatively large number of investors that plan to allocate capital towards residential, industrial / logistics and offices in 2022. The level of dispersion that we observe provides further food for thought, especially for offices, where differences in opinions are most pronounced. This indicates a wide array of views about the future of this sector. Clearly, investors are weighing to what extent hybrid working policies that were introduced in response to COVID-19 will remain in effect going forward. This can significantly impact the demand for office space in many markets and may affect allocation decision making well beyond 2022 as a result. It begs the question to what extent hybrid working will change the dynamics for the office sector, and whether it will be of a similar magnitude to what e-commerce has done to retail and industrial / logistics allocations over the past decade? Only time will tell.

1. Other sectors include: agricultural, aged care, health care, hotel, leisure, parking, student housing and mixed.