Measuring Performance 101

When it comes to fund performance, various measures can be used. First off, it is good practice to understand the fund's characteristics such as the vehicle structure, strategy and vintage, and what insight one is looking for when choosing a performance indicator.

When a manager has control over a fund's cash flows, such as in a closed end fund, the Internal Rate of Return (IRR) gives a good understanding of the fund's results from the investor perspective. However, due to the central role that the cashflows have in the calculation, the IRR is not appropriate for open end fund structures.

Instead, the Time-weighted rate of return (TWR) is the appropriate performance metric used when the fund has an open end structure. It provides a reasonable valuation of the manager's ability to perform, removing the timing influence of cash flows from the calculations. TWR can also be applied to different fund structures, including closed end vehicles, allowing investors and managers to compare their performance against other funds and market indices.

What's your performance?

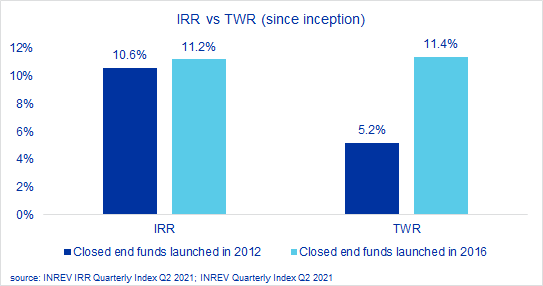

Diving into INREV data, let’s take a closer look at the closed end funds launched in 2012 and 2016 using the INREV Internal Rate of Return (IRR) Index Q2 2021 and the INREV Fund Index Q2 20211. We see that their since inception average annual internal rate of return (IRR) is 10.6% and 11.2%, respectively. In contrast, when we use the time-weighted rate of return, the annualised total returns for the closed end funds are 5.2% and 11.4%, since their launches, respectively.

The internal rate of return (IRR) and the time-weighted rate of return (TWR) are two ways of looking at the performance, providing two different insights. The IRR shows the result of an investment as experienced by an investor, while the TWR shows the effects of manager skills and the market influence on the performance of the funds.

A measure for investors: the Internal Rate of Return

The IRR is the implied discount rate that equates the present value of all the fund's cash inflows (capital contributions) with the sum of the current value of all the cash outflows (distributions and redemptions) and the unrealised present value of the residual investment (NAV).

It is appropriate for measuring the performance of closed end funds due to their finite structure and the fact that the fund's manager has a greater degree of control over the timing of the cash flows. Closed end fund managers withdraw cash when investment opportunities arise and return it to investors when the fund meets its investment objectives.

In contrast, new subscriptions and inflows to open end funds are unpredictable, and once collected, they are promptly deployed, similarly to the capital to investors after a redemption request. Because of this, IRR is not an appropriate measure for open end structures.

It is worth remembering that IRR is affected by the timing and the magnitude of cash flows into the fund. The formula takes each cash flow into account and calculates an overall (internal) rate of return over time by weighting each time period by the amount of cash that flowed at that moment. For this reason, it is not wise to use IRR as an indicator to compare funds with different strategies or vintages.

However, the IRR is a good indicator of a fund’s performance considering the year it was launched and the path of cash flows, and the INREV IRR Index makes a good example.

The Time-weighted return: the performance of the investment manager

To overcome the comparison problem and evaluate different funds regardless of their year of first closing or structure, the time-weighted rate of return can be used.

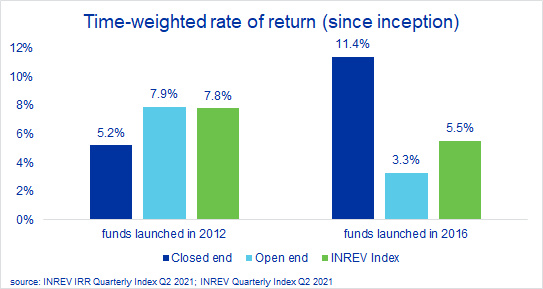

This chart compares the results of the open end and closed end vehicles launched in different years and against their overall INREV Index for their respective vintages. ‘This is only possible when using the TWR.

Unlike the IRR, the time-weighted rate of return measures the performance over a specific period, eliminating any effect deriving from the size or timing of external cash flows, leaving only the influence of the market trends and management decisions.

The most common way to compute the TWR is to use the Modified Dietz2 method to calculate the return of the subperiod (such as quarters). The next step is to chain link the quarterly returns together to calculate a fund's performance over the desired time horizon, be it one or five years or since inception.

The TWR formula seeks to standardise the performance calculation, enabling an apples-to-apples comparison between the funds or with market indices.

Conclusions

The way cash flows are treated is at the heart of all the variations in performance measures. While the time-weighted rate of return removes the impacts of cash flows to evaluate the outcome of an investment, the IRR incorporates cash flows and gives a rate of return that represents their timing and magnitude.

These two measures are complementary: while the IRR is concerned with the long-term performance of the capital invested and distributed to the investor, the time-weighted rate of return indicates the manager's ability to perform and serves as the foundation for comparing composite returns across funds.

To find more information about these metrics and the INREV Indices, please consult our INREV Index Guide.