The rising importance of the living sector in non-listed portfolios

If you’ve been watching trends in the European non-listed real estate, one thing is clear: the Living sector is dominating the scene. Comprising residential and student housing funds, living is now the largest segment within the INREV Fund Index — not just in terms of allocations, but also in the number of single sector funds.

And it is expected to keep on growing. Over the past decade, the living sector has grown substantially, and all signs, from sentiment to investment intentions, point to the momentum continuing. To help investors keep track of this evolving sector, INREV recently launched the INREV Living Fund Index.

A sector on the rise

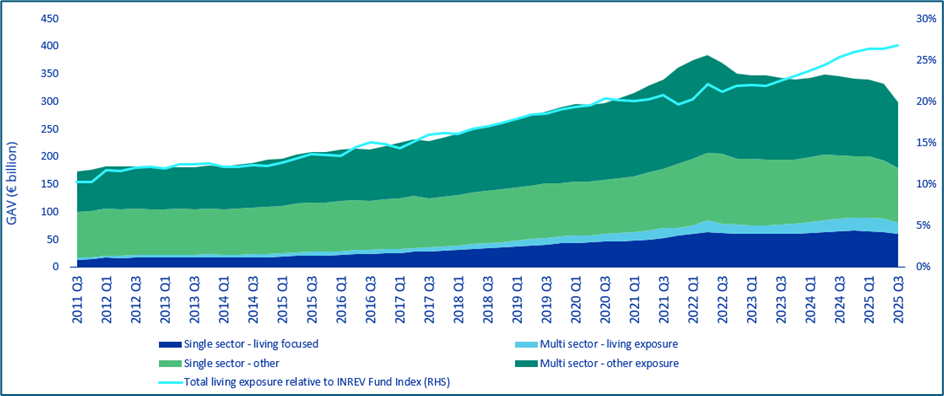

Over the past 25 years, the living segment has increased in size. The numbers tell a compelling story. In 2001, there were only 4 funds with a dedicated strategy to invest in living. Now in 2025, that number has jumped to over 50 funds according to the new INREV Living Fund Index. But it's not just the number of funds that’s increasing – the weightings to living within broader portfolios are rising too. Take multi-sector funds in Europe: their average living allocation has increased from 6% in 2011 to over 14% in 2025. Across the wider INREV Fund index, the combined living allocation jumped from 10.3% in 2011 to 26.8% in Q3 2025. That makes it the largest sector, surpassing Industrial/logistics (25.3%), office (20.2%) and retail (11.9%).

Source: INREV Data Platform

Residential is the preferred sector by investors

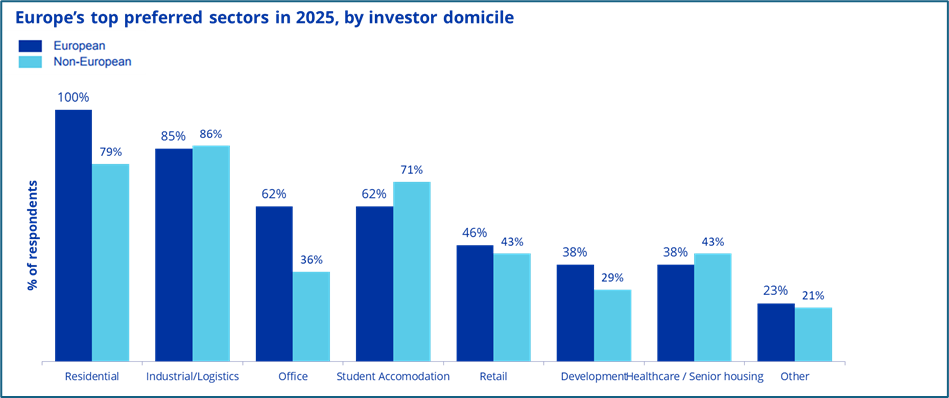

The Living sector, and in particular residential, is not just growing but also capturing investors' attention. According to the 2025 ANREV/INREV/NCREIF Investment Intentions Survey, residential continues to be the most preferred sector in Europe, especially among European investors.

For non-European investors, it’s slightly different. For them, industrial/logistics takes the top spot, with residential in second place and student accommodation coming in third. This lower appetite for European residential could be influenced by the exposure they already have in their own region. Looking at the Global Real Estate Fund Index, the numbers are telling: in the US residential allocation reached 28.2% in Q2 2025 — slightly higher than in Europe — the Asian Pacific region lags at 4.8%. These geographical differences might impact their investment intentions in Europe as well.

Source: ANREV/INREV/NCREIF Investment Intentions Survey

Positive sentiment drives Residential and Student Housing

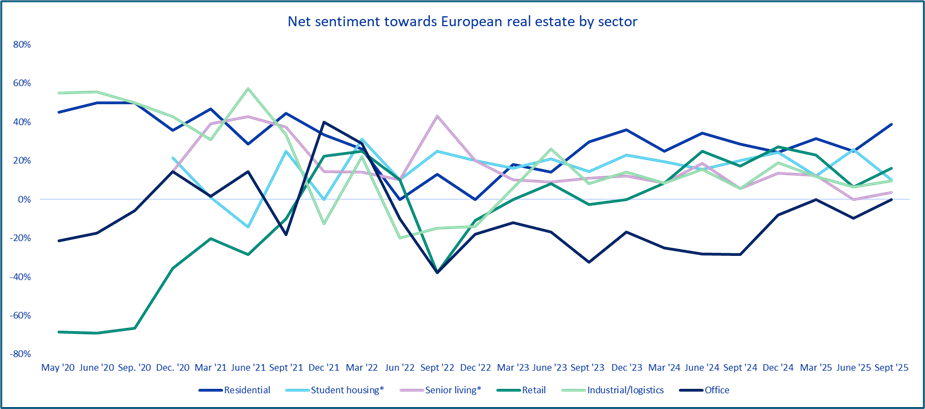

It’s not just about investment intentions; market sentiment tells a similar story. Industry experts consistently express a more positive outlook for residential, a trend visible over the last six years. The only notable exception was in 2022, when rising energy costs and interest rates shook confidence. Since residential assets typically generate lower income returns, they are naturally more sensitive to these shifts.

Meanwhile, sentiment towards student housing has been generally positive, except during the COVID-19 period when international travel among students was limited. Senior housing has been positive since the Consensus Indicator Survey was launched, though current sentiment is relatively weak — higher only than the office sector, which currently has the weakest sentiment.

Source: INREV Consensus Indicator Survey, September 2025

All signs point to one thing: residential and student housing are essential to the living sector's future growth.

If you would like to learn more about the INREV Living Fund Index and tool please reach out to the INREV team, including Bert Teuben or Giulio Cappelloni.