Selective optimism: how investors are repositioning in European real estate

In 2026, European real estate investment intentions point to a market gradually regaining confidence, shaped by selective optimism and renewed focus on asset selection. This year’s INREV Investment Intentions Survey highlights how investor preferences are evolving, with established destinations retaining their appeal, new destinations emerging, and notable shifts in sectoral preferences across markets.

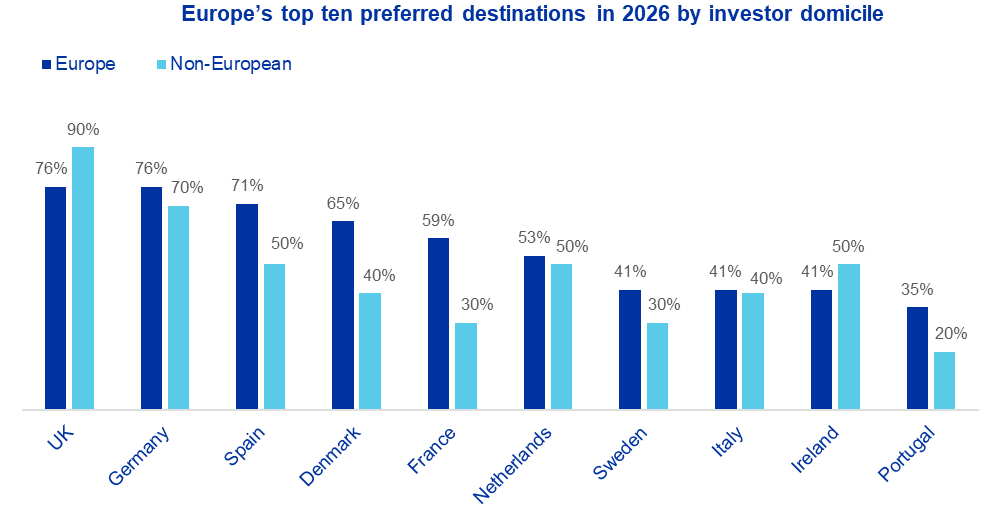

The United Kingdom once again stands out as Europe’s most preferred investment destination. Attracting strong interest from both European and non-European investors, the UK rose to the most preferred destination across all global markets this year, underlining its enduring role as a key market for investors globally. The office sector remains the dominant preference in the UK, reinforcing the country's position as a market offering scale, transparency and liquidity.

Germany retains its place among the top investment destinations in 2026, reflecting consistent investor demand. Confidence remains high among both European and non-European respondents, supported by the market's depth and strong occupier fundamentals. Industrial/logistics and residential sectors once again feature as the most attractive sectors, with major urban centres remaining key focal points for deployment. Despite ongoing macroeconomic and political headwinds, Germany’s long-term appeal remains intact.

Figure 1: Europe’s top ten preferred destinations in 2026 by investor domicile

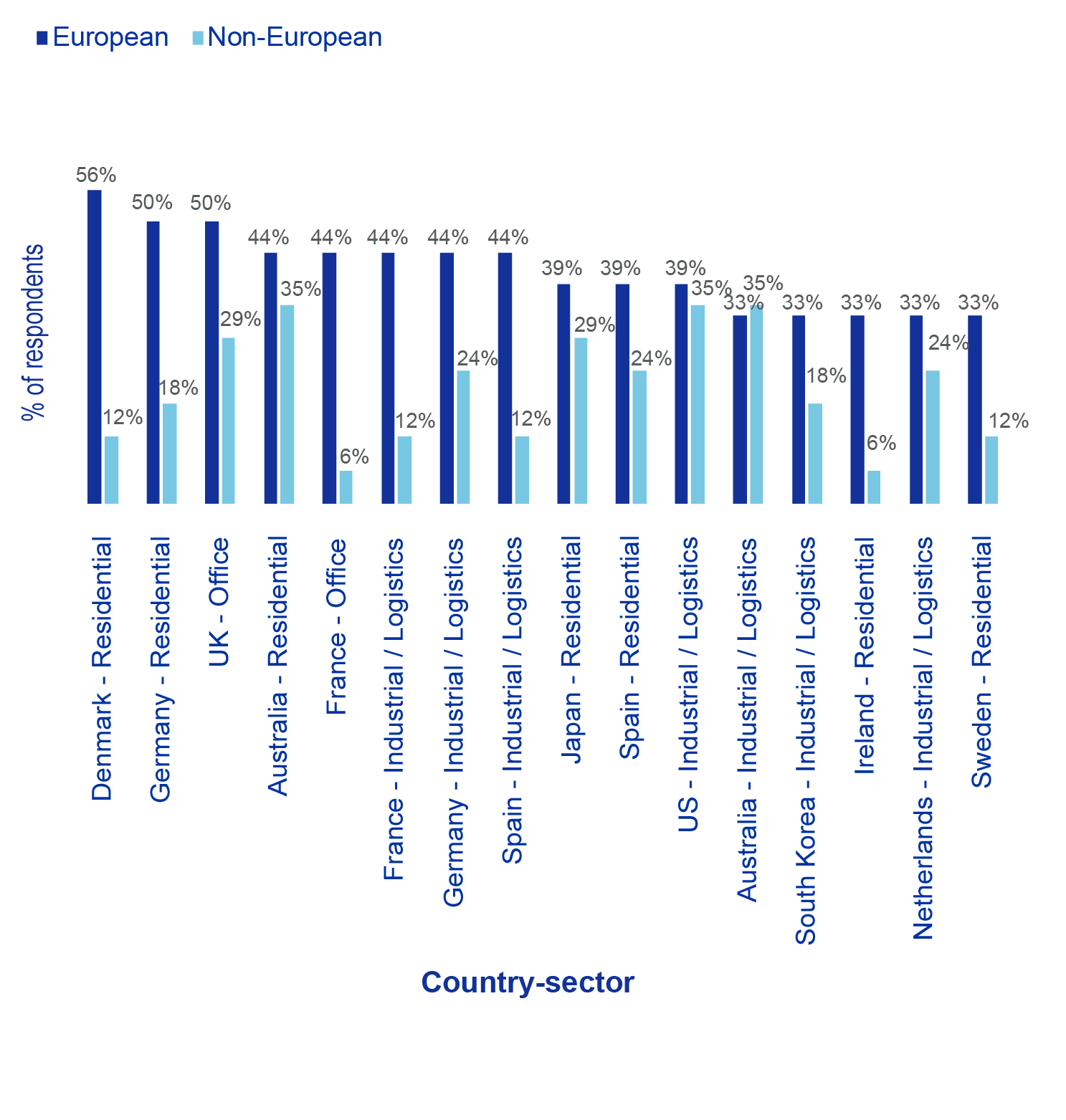

France presents a more nuanced picture this year, continuing to fall in preferred location rankings to sixth place in 2026. Political risks continue to weigh on sentiment in the French real estate market, combined with sluggish economic growth in recent years. Europe’s preferred destinations also highlight growing investor interest in smaller, stable secondary markets. Denmark has risen to become the fourth most preferred European destination in 2026, reflecting strong demand for transparent, sustainability-compliant markets. Interestingly, this year, the Danish residential market ranks as the most favoured country-sector combination globally for investors.

Figure 2: Preferred country-sector combination by investor domicile (global)

Ireland also records a notable milestone, entering the European top ten destinations for the first time and ranking seventh overall. This shift points to increasing investor confidence in Ireland’s long-term fundamentals, supported by a growing and youthful population, resilient economic performance and recent regulatory developments in the living sector that have helped create a more favourable environment for institutional capital. Growing interest in these markets underlines a broader trend among investors towards diversification beyond Europe’s largest markets.

Sector preferences in 2026 remain anchored in residential and industrial/logistics, which continue to dominate investment intentions across Europe. These sectors are favoured by investors for their income resilience and alignment with long-term secular trends. This year, the office sector and developments entered the top three sector preferences in joint-third place.

Outside of the traditional sectors, there is a mixture of responsibility between real estate and infrastructure teams when it comes to data centre allocations, with nearly half of respondents indicating that both real estate and infrastructure teams are responsible. The sector remains on investors’ radar, reflecting the demand drivers linked to data storage and processing needs from digitalisation and artificial intelligence.

Sustainability continues to play a central role in investment decision-making, although timelines for net zero are evolving. In 2026, nearly 60% of investors report having set net zero targets, marking an increase compared with last year. However, investors increasingly favour post-2040 timelines.

Overall, the 2026 INREV Investment Intentions Survey shows a European real estate market characterised by cautious engagement rather than broad recovery. Larger markets with scale, such as the UK and Germany, continue to dominate preferences, while selective opportunities in secondary markets and resilient sectors are increasingly in focus. As investors navigate an uncertain macroeconomic environment, selecting the right assets remains central to unlocking opportunities across Europe’s real estate landscape in this cycle.