Sentiment towards German real estate turns negative

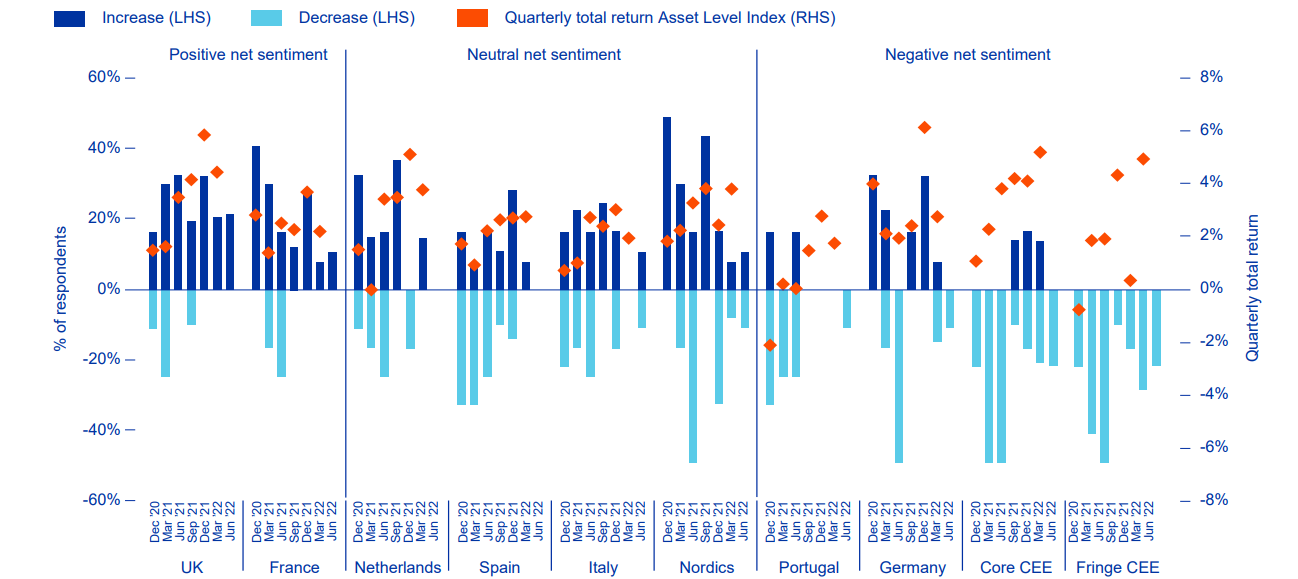

The latest June edition of the INREV’s Market Insights publication confirms the turnaround in investment sentiment that started to come through in March this year, and Germany’s position stands out more negatively than most other geographies. Sentiment for Germany deteriorated rapidly over the last two quarters with 11% of the respondents intending to decrease their real estate allocations to Germany and none intending to increase. This is a strong contrast from a shared first place it held in December edition of the Survey alongside France, when 33% of investors and investment managers intended to increase allocations and none intended to decrease, and a further deterioration from the net -7% allocations intentions at the end of March (see Figure 1).

Figure 1. European real estate allocation intentions and performance by geography

While the INREV Sentiment Survey doesn’t explicitly provide insights into why Germany has seen such a negative shift in sentiment, several explanatory factors come into play. Given its strength and timing– the war in Ukraine is the most significant change since December 2021 when sentiment towards Germany was still a strong positive. The higher the geopolitical uncertainty, the lower the business sentiment, and the geopolitical uncertainty can’t be much higher right now. The significant buildup of inflationary pressures (in particular, energy and food) and further stress on global supply chains are adding to surging costs, bottlenecks, and delays in supply chains, not to mention the resulting slum in discretionary spending, all of which are Europe’s reality today, and Germany is no exception.

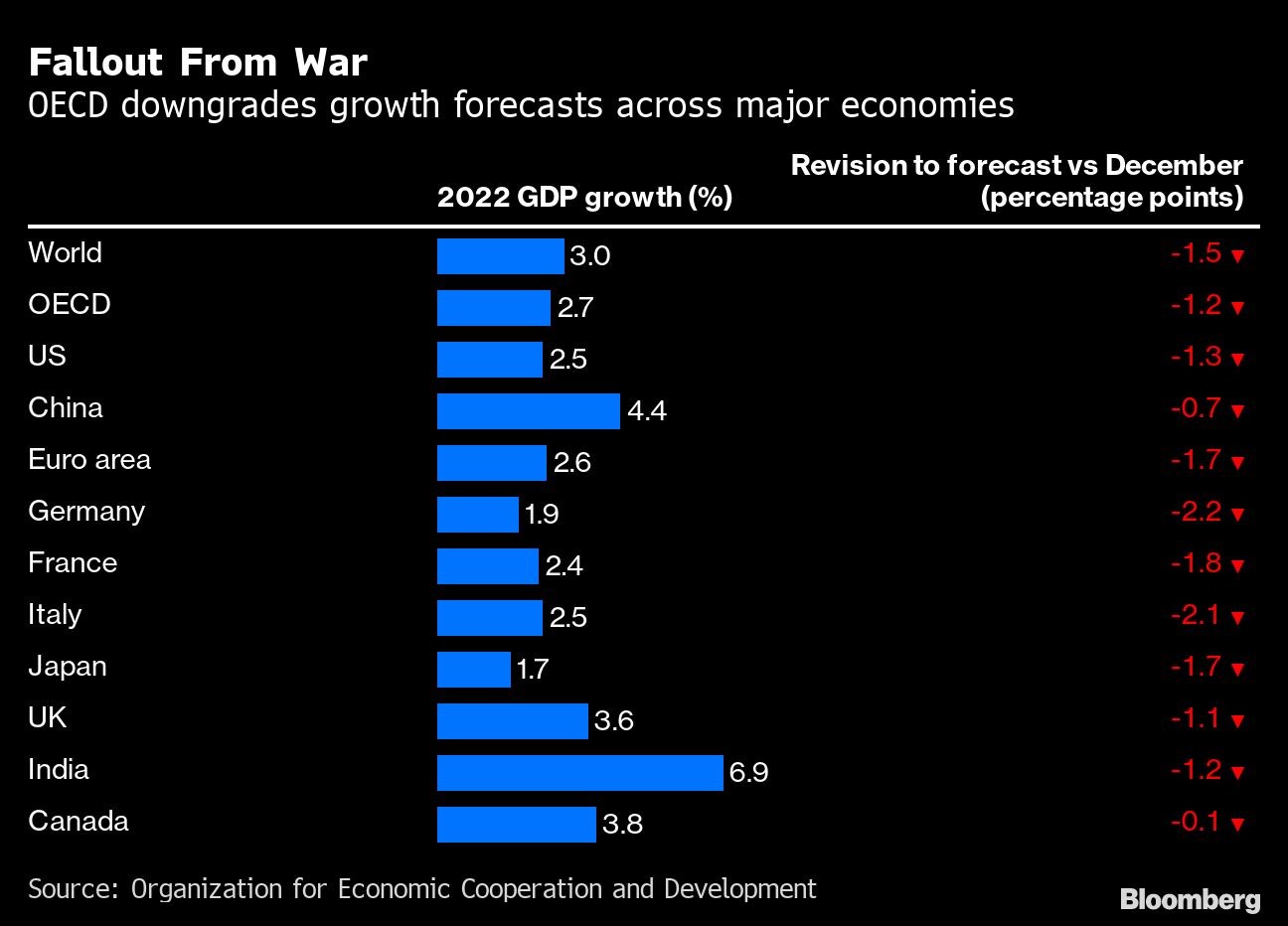

Due to Germany’s extortionary high energy import dependency and rising costs and bottlenecks in the manufacturing industry (with key sectors being the automotive, mechanical engineering, chemical and electrical industries) – the economic outlook is strongly impacted, and growth expectations are revised down significantly. In the third week of June, Germany's BDI industry association slashed its 2022 economic forecast to 1.5%, down from the 3.5% forecasted before the war in Ukraine broke out. Furthermore, BDI warned that a halt in Russian gas deliveries would inevitably lead to a recession in Europe's largest economy. OECD too downgraded its economic forecasts for all major global economies. At 1.9%, the 2022 GDP growth expectations for Germany are now second lowest among the world's largest economies, with only Japan expected to have a weaker growth of 1.7%. Relative to the 2022 forecasts as of December last year, the 220 bps downward revision for Germany was the highest, even above the 210 bps downgrade for Italy.

Figure 2. ODCE 2022 economic forecasts downgrades

This will negatively affect the outlook for all asset classes, including non-listed real estate performance. While it is difficult to give a prognosis on the severity of the impact, it is the most likely trigger behind the change in sentiment towards German non-listed real estate first reported in March and a further deterioration we see today.

The bottom line is the period of strong capital growth is coming to an end, and for German real estate, the change in speed and the accompanied correction in pricing may be more abrupt than in many other European markets

So what does it all mean for real estate performance and pricing?

It is worth highlighting that the German market delivered impressive performance results in 2021 – a one-year rolling asset level return of 14.28%. It is reversing rapidly as the latest Q1 2022 asset level performance figures are much more muted, falling to 2.84% in Q1 2022 compared to 6.29% in Q4 2021, albeit this is also down to seasonal effects. Market evidence and the latest transaction pricing reveal that softening in yields in Germany is already underway. We expect that the Q2 2022 data will reveal the extent of correction and it would be interesting to see what sectors or market segments are weathering the underlying condition better. The bottom line is the period of strong capital growth is coming to an end, and for German real estate, the change in speed and the accompanied correction in pricing may be more abrupt than in many other European markets.