Lessons Learned

The first article in a series of ‘Lessons Learned’ to help industry players understand how the non-listed real estate investment asset class has developed and how you can learn from past lessons to guide better informed decisions in the future.

It’s 20 years since INREV launched in 2003 with the aim of improving transparency, professionalism and best practice across the non-listed real estate industry in Europe. In those early days the organisation compiled data from 60 funds with a GAV of €31 billion. Today, the INREV Fund Index tracks the performance of more than 320 vehicles with a combined GAV of €320 billion.

Since INREV’s inception, the European real estate market has been exposed to headwinds from the global financial crisis (GFC) closely followed by the European debt crisis, the age of austerity, Brexit, the Covid-19 pandemic, the return of war to the continent and the end of the lower for longer interest rate regime. However, the focus on crashes and busts overlooks periods of stability and growth.

Over the last 20 years European non-listed real estate delivered an overall performance of 272% or an annualised average total return of 5.1%. In Alan Greenspan’s goldilocks years when the developed world benefitted from a benign macro-economic environment that was ‘not too hot and not too cold‘, European non-listed real estate produced total returns of 10.9% a year.

Google’s Community Mobility Reports indicate that searches for workplace destinations in Central London were just 30% of pre-pandemic levels at the end of 2021.

This fell back to -2.4% in the five years ending December 2012 when Europe’s economies struggled with a systemic threat to the banking system and unsustainable levels of sovereign debt in Portugal, Ireland, Italy, Greece and Spain. Banks and bankers were seen as the villain of the peace and the cause of the policy of austerity imposed by the ECB, IMF and European Commission troika in response.

Light touch financial regulation pre-2008 had created an almost cavalier attitude to risk taking and a competitive bank lending regime. The average level of gearing rose to 40% across INREV’s All Funds index. But in some sectors and countries it reached 60%. At that higher level a 20% fall in capital values translated into a 50% fall in equity.

Tougher banking regulation through Basel II and III has now curtailed excessive risk taking. Today, the average level of gearing across INREV’s All Funds index is 20%. At this level a 20% fall in capital values translates into just a 25% fall in equity (see Chart 1).

The real estate investment landscape changes along with the macro-economic background. Mario Draghi’s ‘whatever it takes‘ speech was followed by ten years of zero or sub-zero interest rates. European real estate benefitted from investors’ hunt for yield and the low cost of capital. Average annual total returns were running at an annualised 7.1% until the middle of last year.

Initially, investors chased trophy assets perceiving that they were cheap after ten quarters of falling capital values between 2007 and the end of 2009. Shops in Bond Street and Champs Elysees together with offices in the CBDs of London, Paris, Frankfurt and Amsterdam and Madrid changed hands at ever increasing valuations. The steam came out of these markets with the growth of on-line retailing and the imposition of near continent-wide pandemic lockdown.

London was already suffering the fallout from Brexit when like every other major European city it faced the impact of working from home. Google’s Community Mobility Reports indicate that searches for workplace destinations in Central London were just 30% of pre-pandemic levels at the end of 2021.

Before the pandemic, the growth of on-line retailing had posed a threat to traditional high street shops and boosted the demand for industrial space that could provide 100,000 m2 fulfilment centres and smaller last mile delivery units. During the pandemic the movement of consumers on-line accelerated and the demand for logistics space to fulfil the ever increasing volume of orders drove rental values ever higher. The almost “irrational exuberance” of investors sent industrial yields to levels that had previously only applied to the world’s most famous shopping destinations.

The latest development in the real estate cycle has been caused by increasing inflation and central banks use of monetary policy in response. Post pandemic supply chain problems followed by Russia’s war against Ukraine have caused a spike in food and utility prices. Interest rates have been rapidly increased in response.

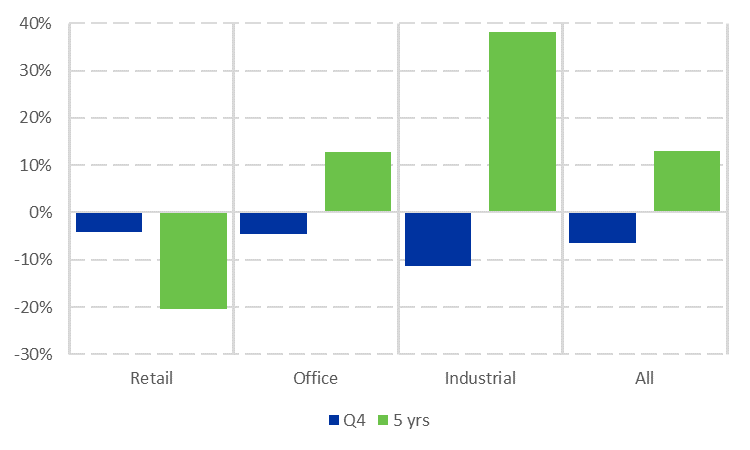

The cost of debt is rising making new loans and re-financing more expensive. In addition, increasing risk free rates are feeding through into higher capitalisation rates. Industrial valuations on INREV’s Asset Level Index, excluding the impact of vehicle level structures including fees and gearing, declined by -11.4% in Q4 but are still 38% up in the last five years. Retail valuations are 20% lower than five years previously and only fell -4.1% in Q4 (see Chart 2). A yield de-rate of 1% plus has more impact for assets trading at 3% than it does for assets trading at 8%.

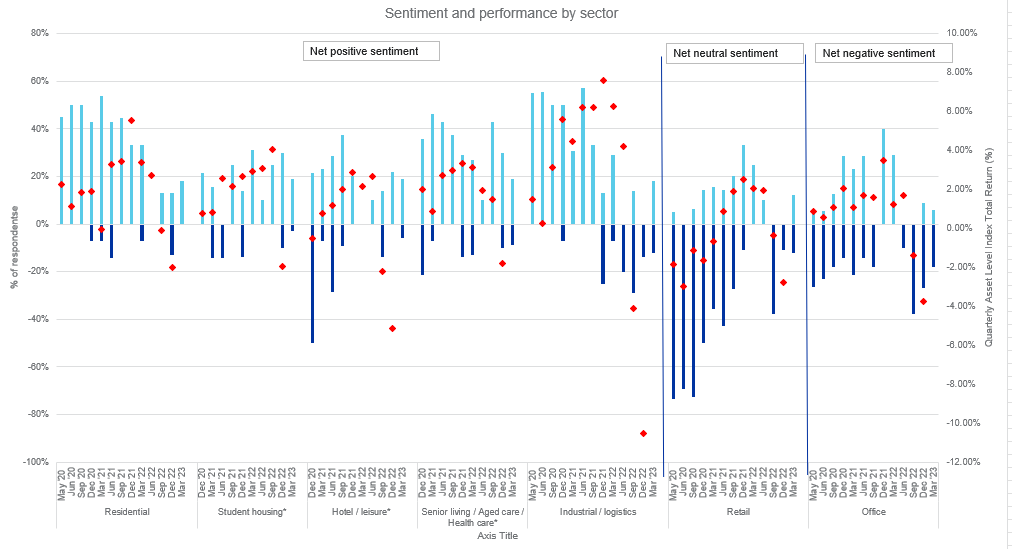

The next challenge for real estate is the transition to a carbon neutral environment. Increasing operational efficiencies and reducing embodied carbon in real estate development are huge challenges and carry notable cost implications. Yet the cost of retro-fitting has yet to be truly reflected in valuations, and it is particularly significant for city centre offices and shopping centres. Will offices be the next real estate sector to face a pro-longed price correction as the latest Consensus Indicator Survey suggests (see Chart 3).