Italy on the rise: fresh data shows short- and mid-term outperformance

With growing interest and improving sentiment toward the Italian market, we are reintroducing performance insights for Italian-focused funds within the INREV Fund Index. Latest results highlight stronger performance compared with the broader European market, with detailed analysis available at both fund and asset levels.

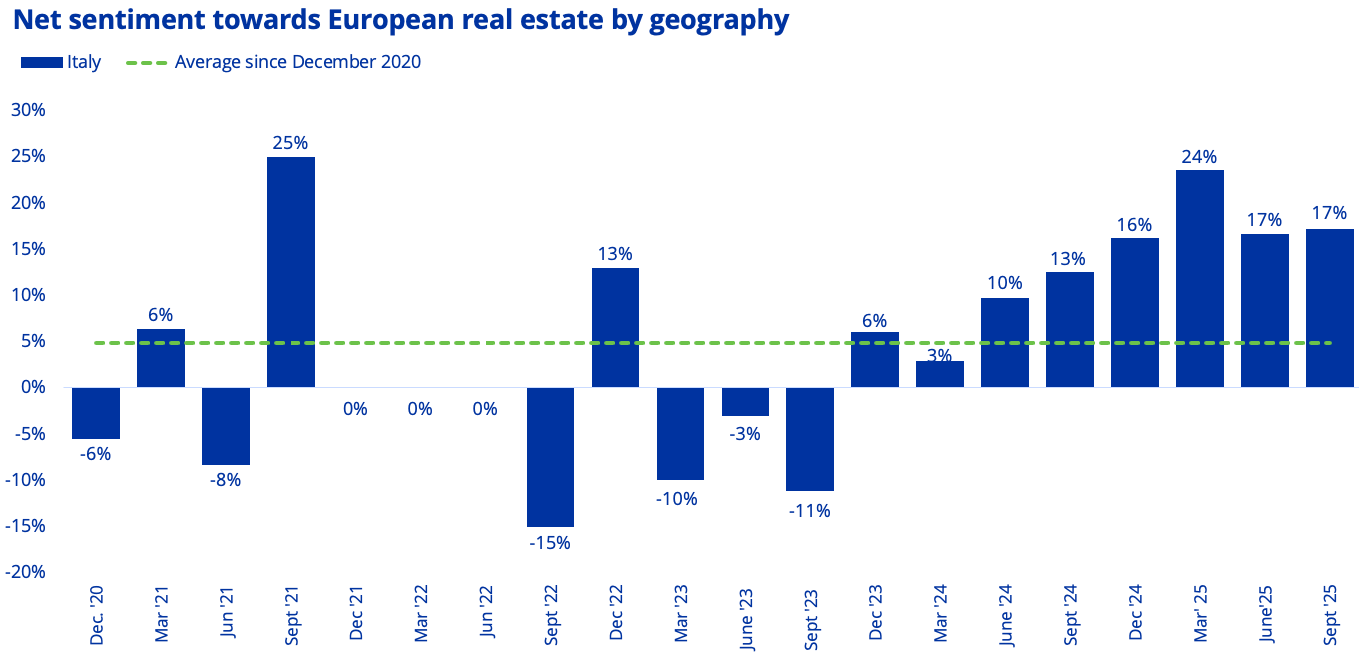

Italian market sentiment surges: strong sentiment in the past six quarters

INREV Consensus Indicator shows a clear and sustained positive sentiment toward the Italian real estate market over the past six quarters. Net sentiment has consistently stayed above its long-term average of 5%, signalling a solid recovery in investor and manager expectations. Within the European context, Italy ranks second, tied with Germany, among the main European markets, positioning itself as one of the most preferred markets in the current cycle. This strong sentiment naturally leads to the question of how it has translated into recent performance trends.

Source: INREV Consensus Indicator, September 2025

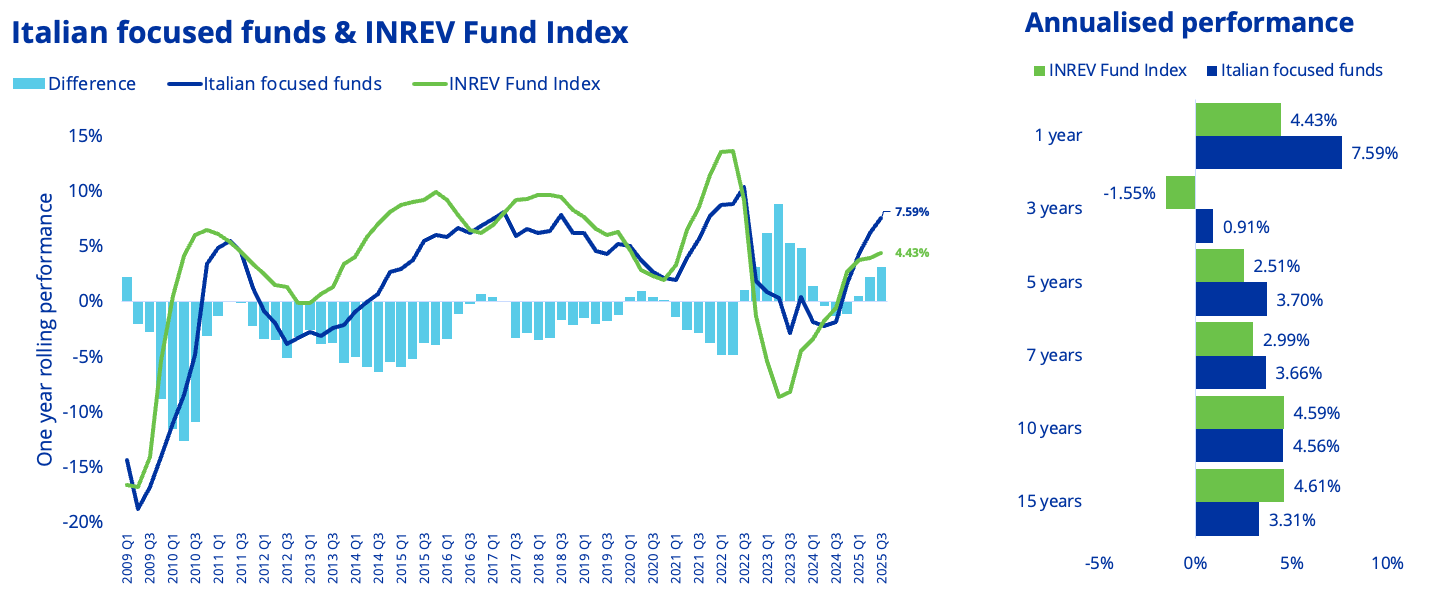

Increased sentiment reflected in recent outperformance

After ten quarters of inactivity, performance insights for Italian-focused funds are now available again, supported by improved data reporting from domestic managers. As of Q3 2025, the index includes eight Italian closed end funds with a combined gross asset value of €1.9 billion. With historical data dating back to Q2 2008, the index provides over fifteen years of continuous evidence on performance trends in the Italian non-listed real estate fund universe.

To place Italian results into a broader context, performance has been compared with the INREV Fund Index, composed of 302 vehicles with a GAV of €298.7 billion, as of Q3 2025. The comparison reveals a recent pattern of outperformance: Italian-focused funds have exceeded the returns of their European counterparts across both short and medium term horizons. The one-year rolling total return reached 7.59% in Q3 2025, significantly higher than the 4.43% recorded by the INREV Fund Index. Similar outperformance is visible across the 3-, 5- and 7-year annualised figures, highlighting a structural rather than cyclical advantage.

Source: INREV Fund Level Index, September 2025

However, Italian-focused funds have underperformed the wider INREV Fund Index over the longer horizons (10- and 15-year annualised returns), largely due to the euro-area sovereign debt crisis, which hit Italy’s real estate market harder than the rest of Europe. As the chart shows, Italian-focused vehicles delivered consistently lower one-year rolling returns from 2009 through to 2015.

More recently, Italian-focused funds have demonstrated lower volatility and a more stable performance trajectory than the broader European universe. This resilience was particularly clear during the recent downturn, between Q4 2022 and Q3 2024, when Italian funds experienced a smaller downturn and a faster recovery. This pattern suggests that Italy’s improved fundamentals and more disciplined market structure are now translating into a more robust return profile.

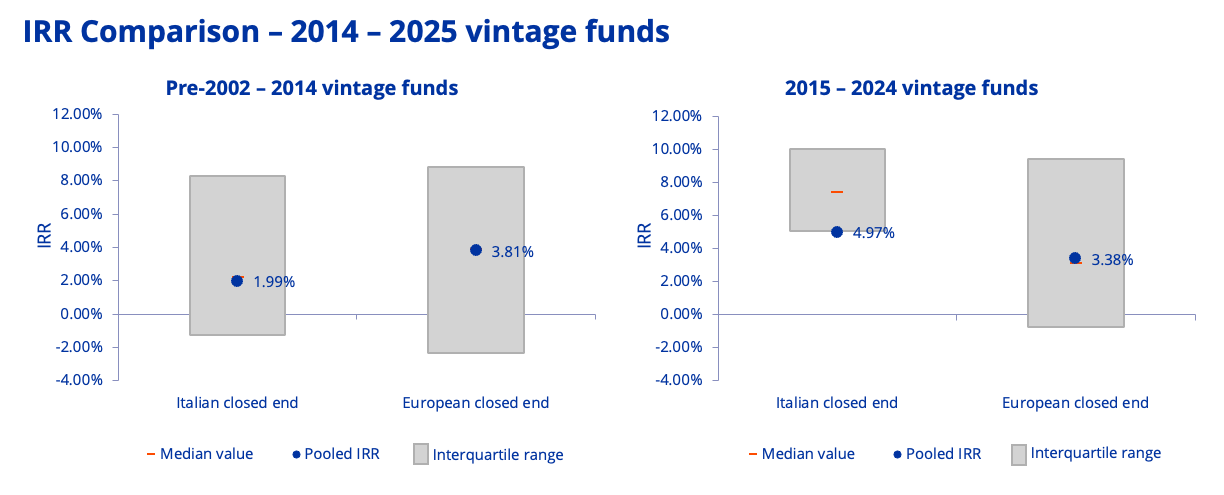

IRR results highlight long-term strength

The INREV IRR Index provides further evidence of Italy’s improving fund performance. While Italian vintages launched before 2015 underperformed their European peers, funds launched between 2015 and 2024 show higher pooled IRRs with lower dispersion, indicating stronger and more consistent performance in recent years.

Source: INREV IRR Index, September 2025

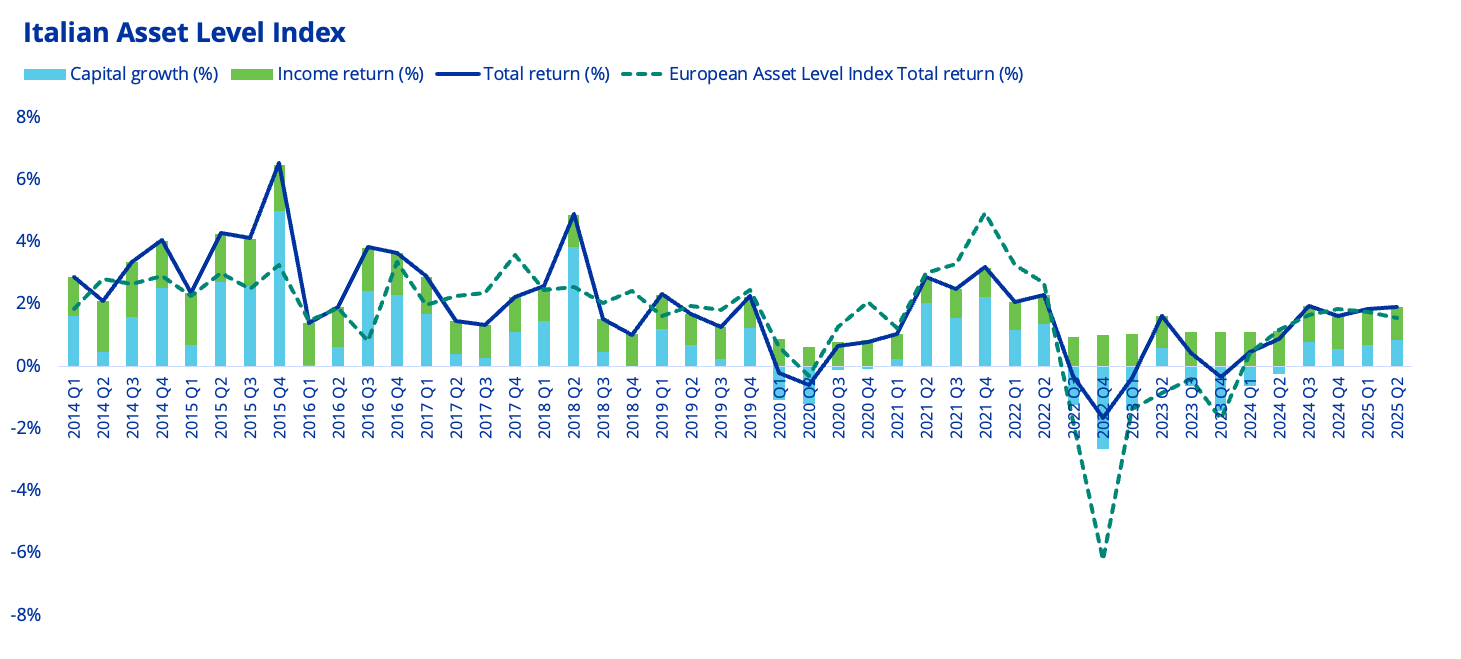

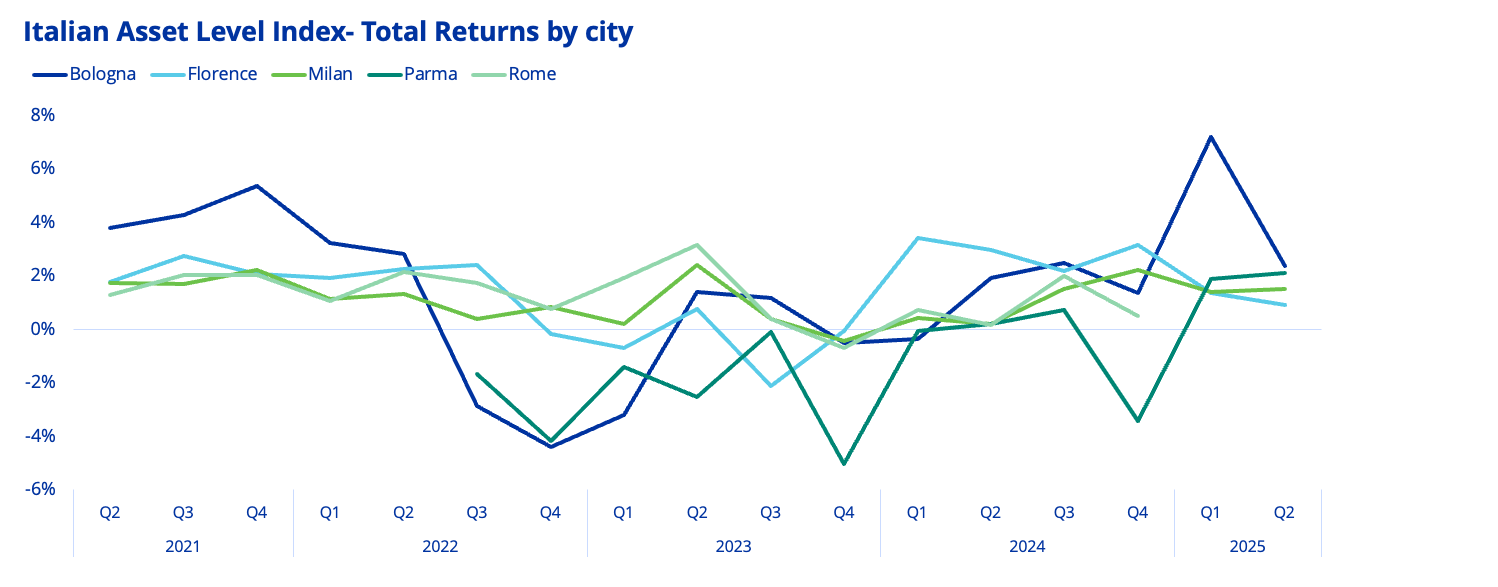

Italian assets outperform broader Asset Index in 2025

Italian assets have continued to deliver robust performance, according to the INREV Asset Level Index, posting positive returns every quarter since Q1 2024. In Q2 2025, total returns reached 1.92%, with positive capital growth of 0.84%, marking the fourth consecutive quarter of growth. The Italian Index achieved one-year annualised returns of 7.52%, outperforming the broader European asset level Index, which recorded 6.91%.

Source: INREV Asset level Index, September 2025

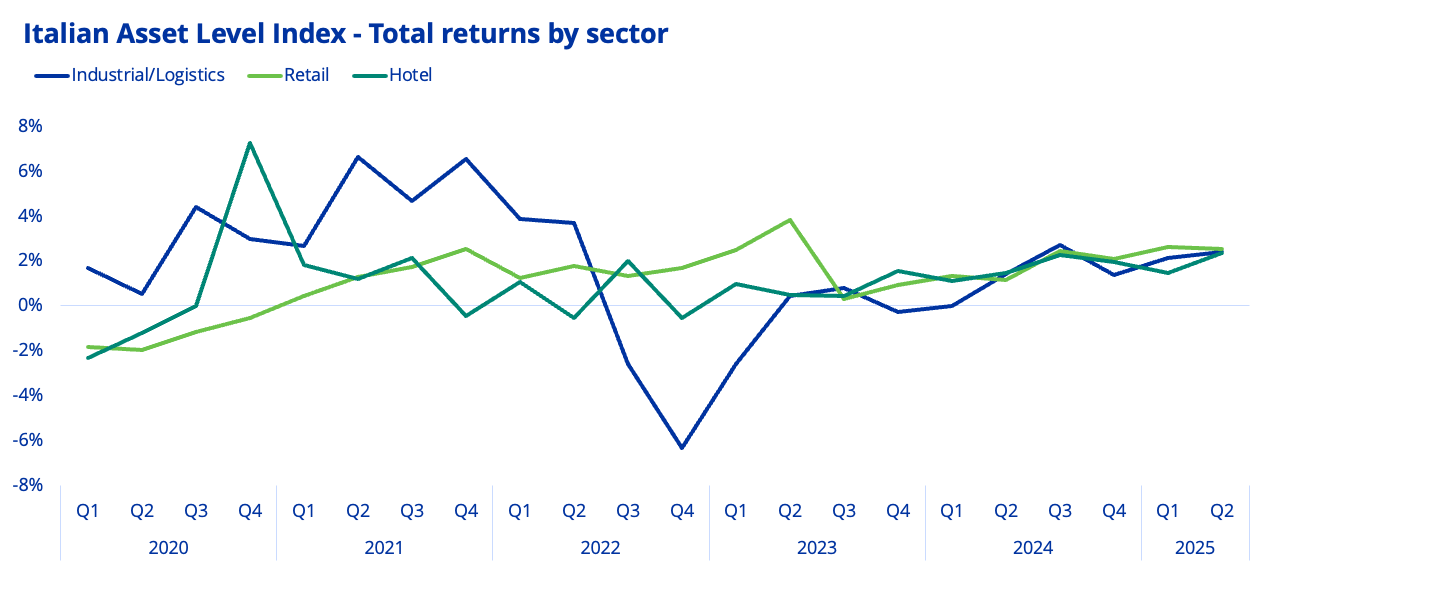

According to the INREV Asset Level Index, Italy’s best-performing sector over the past three quarters has been retail (2.55% total return in Q2 2025), highlighting the strength of the Italian retail fundamentals. Whereas many markets rely heavily on out-of-town retail parks (for example, the UK) or large regional shopping centres, Italy’s strength lies in high-street and city-centre retail, especially on flagship streets. In Q2 2025, retail investment volumes reached roughly €670 million, bringing the H1 2025 total to €1.24 billion, more than double the level of H1 2024¹. Prime high-street locations are benefiting from rising rents and yield compression, particularly in top-tier districts.

Source: INREV Asset level Index, September 2025

At the same time, the industrial/logistics sector is emerging as a major pillar in Italy’s non-listed property universe and represents 44% of the value of the Italian index sample as of Q2 2025. Investor demand remains strong, quarterly take-up remains healthy, and vacancy rates are low in key logistics clusters². These dynamics have translated into total returns for industrial/logistics assets that are close to, and in some quarters rival, those of retail.

Source: INREV Asset level Index, September 2025

As the year draws to a close, it remains to be seen whether the recent improvement in sentiment towards the Italian non-listed real estate market will be sustained. However, recent quarters have demonstrated continued resilience at both the fund and asset level, supported by stable fundamentals and solid performance in key sectors.

If you would like to participate, or schedule a demo of the Asset and Fund Level Analysis tools, contact Giulio Cappelloni (giulio.cappelloni@inrev.org) or Jeanne Besner (jeanne.besner@inrev.org) or visit the Data page.