SDDS (Standard Data Delivery Sheet)

Since 2012, the Standard Data Delivery Sheet (SDDS) has provided a singular reporting format for investment managers and investors to exchange information. This creates uniformity, transparency and operational efficiencies between both parties. The latest update, SDDS 4.0, is aligned with current industry developments and changing investor needs, to ensure it remains practical and useful in today’s market. INREV has also introduced the ESG SDDS, an ESG reporting template designed to standardise the disclosure reporting of ESG Key Performance Indicators (KPIs) for real estate investment vehicles.

If you would like to access the unprotected version of the SDDS, please send your request to professional.standards@inrev.org

DOWNLOAD

How is the INREV SDDS 4.0 structured?

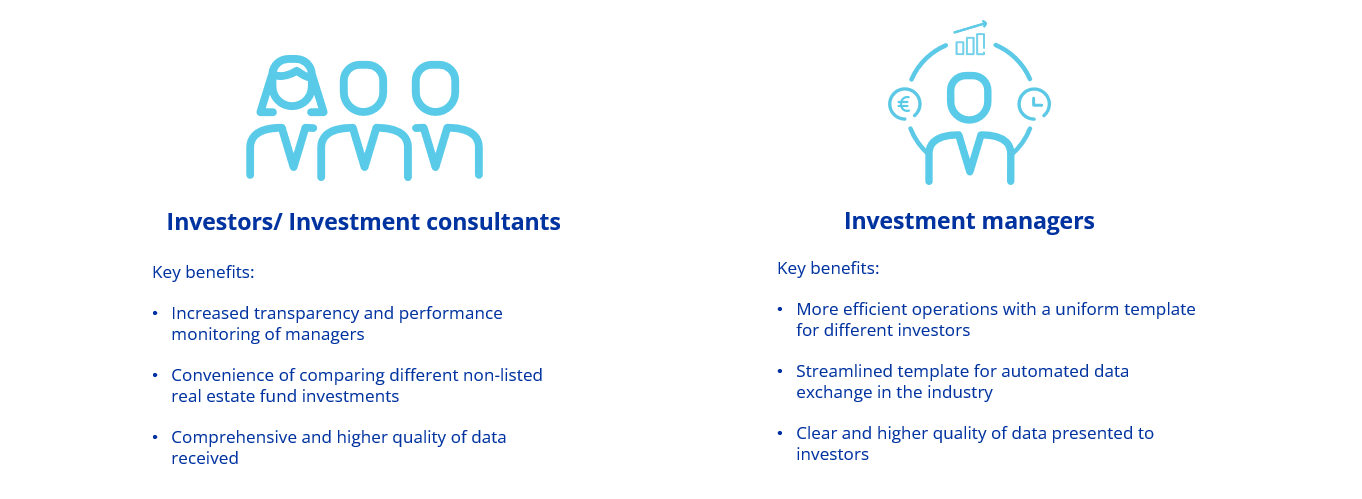

Who should use the SDDS?