European Real Estate Debt Markets Set To Move Up A Gear

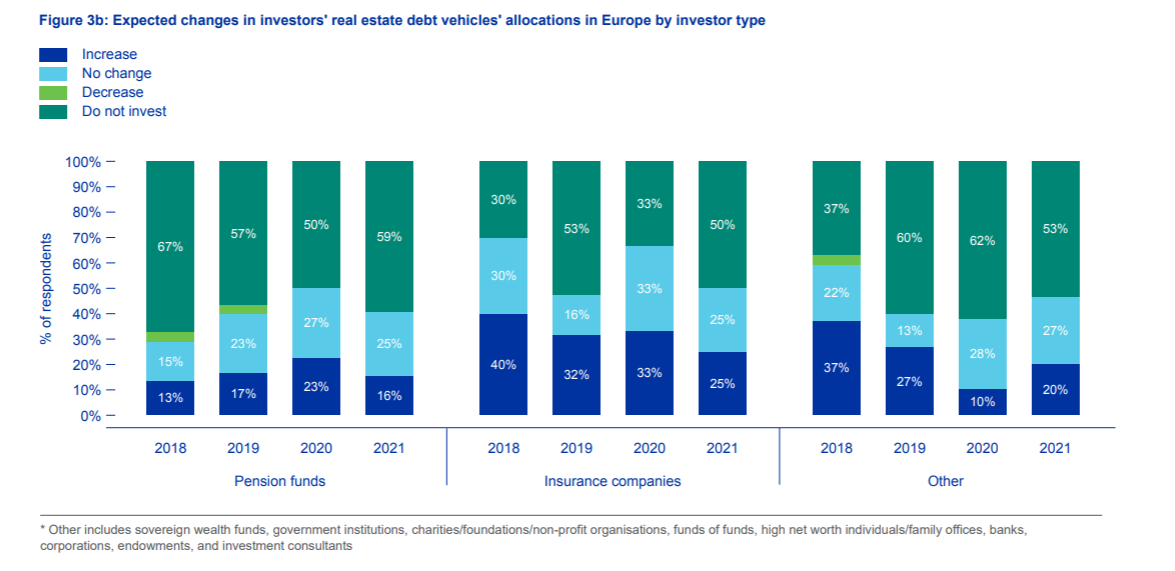

Over the past decade, the INREV, ANREV, PREA Investment Intentions Survey has shown consistent and growing appetite for exposure to real estate debt strategies from investors. This has led to a wave of activity and investment from non-traditional lenders including insurance and pension companies, and debt funds.

But, how did we get here and what lies ahead?

Our journey to the present

One of the drivers behind growing investor interest is the opportunity created by the increasingly challenging regulatory environment for banks, which has led to reduced bank appetite for both credit risk as well as real estate risk.

This opportunity appeared in the UK after the GFC, where a series of policy responses to manage risks in the banking sector led to banks’ reduced ability to lend. At the same time, there was a willingness for the market to try something new. This generated fertile ground for non-traditional lenders to thrive; as a result their market share grew over the subsequent decade to 30% of outstanding debt, according to data from Bayes Business School.

These trends are now present and accelerating across the continent1. The finalisation of Basel III and the phasing in of minimum output floors are expected to have a greater effect on banks on the continent . Initial calculations by the European Banking Authority indicate that this will take as much as €125 billion of financing capacity out of the European CRE market.

Continued disintermediation of the traditional sources of financing capital have meant more options for borrowers and more opportunities for non-traditional lenders to capitalise and drive presence in the sector. Our experience from the US tells us that this trend is structural and has further to run.

The rise of non-traditional lenders

Recognising the opportunity, large sources of capital outside of banking are mobilising to channel additional monies to deploy into the sector.

Looking at the activity on the ground, non-traditional lenders are present across the risk spectrum, from core to value add and opportunistic. At the core end, insurance and pension monies are reallocating capital from public markets and seeking an illiquidity premium in CRE debt which can readily compete with banks on their own terms.

At the opportunistic end, availability of bank capital for transitional and development loans will continue to fall as appetite for real estate risk is low and is expected to decline further. In its place non-traditional lenders can step in, providing whole loans, bridging and development capital.

Short term opportunity characterised by long term potential

Europe’s real estate debt market is set to see over €1 trillion2 of upcoming loan maturities across the UK, Germany and France. This wall of refinancing activity is driven by the typical 5-year floating rate loan that characterises the market as well as the pandemic-induced delayed refinancing.

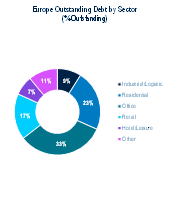

More than 50% of outstanding debt stock3 is in sectors that have been vulnerable to the pandemic, namely retail, hotel / leisure and office. Credit risk deterioration from these exposures will constrain bank capacity to refinance, while the ‘stickiness’ of problem loans will materially restrict banks’ abilities to expand new lending.

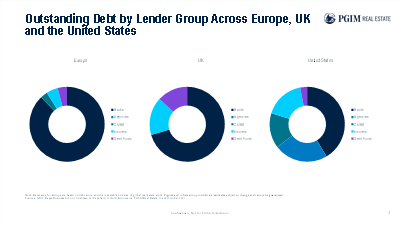

Banks currently hold just under 90% of outstanding European CRE debt, with the remainder split between insurance companies, private debt funds and some limited CMBS activity. However, this varies greatly from one country to another. Structural change is already significantly advanced in the UK where the market share of banks is now 70% and falling.

Looking at the more established US market reveals a potential clue of what is to come, both in terms of % split and composition. Banks in the US hold only around 40% of commercial and multifamily outstanding debt. The remaining 60% is comprised of non-listed debt funds, insurance companies, CMBS and agencies.

Concluding remarks

Concluding remarks

An appetite for change combined with operational and regulatory pressures on incumbent banks are catalysing structural shifts in the European CRE debt market.

The opportunity set for non-traditional lenders is evident across the risk-return spectrum, as banks’ appetite for credit risk and real estate risk continue to be constrained, while borrowers and new entrants meet to diversify further and increase market share.

The INREV Debt Vehicles Universe, a live database of active debt funds has doubled over the last five years to 95 vehicles representing circa €60 billion of target equity.

For media use only. All investments involve risk, including the possible loss of capital.

Full disclaimers available on: www.pgim.com/real-estate/.

This article was written by Henri Vuong, Head of Real Estate Debt Investment Research at PGIM Real Estate and a member of the INREV Debt Working Group and Performance Measurement Committee, and David Gingell, CFA Head of Senior Debt Europe at PGIM Real Estate and a member of the INREV Debt Working Group.

[1] Bank for International Settlements Based III: Finalising Post-Crisis Reforms December 2017

[2] Sources: PGIM estimates based on data from Bayes Business School, IREBS, IEIF, PwC Strategy&, Banque de France (includes institutionally held residential). As of November 2021.

[3] Sources: PGIM estimates based on data from RCA, Bayes Business School, IREBS, IEIF, PwC Strategy&. As of November 2021.