A closer look at European investment intentions for 2024

As the real estate landscape unfolds in 2024, investors are evaluating various European markets with nuanced intentions. The investment intentions for this year shed light on shifting preferences and emerging trends, painting a dynamic picture of the real estate sector across countries. Let's delve into some of the country highlights from this year’s investment intentions.

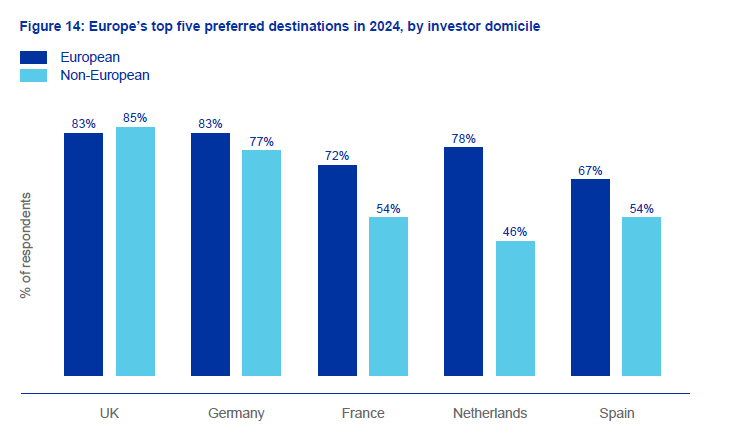

After six years in the wilderness, the UK reclaims its throne as the top European investment location.

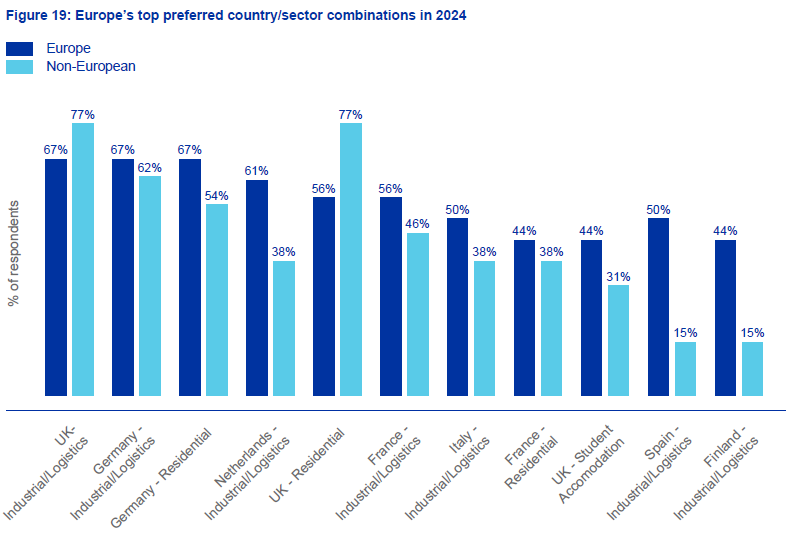

Industrial logistics in the UK emerges as the frontrunner in the country sector ranking, with London dominating as the most preferred city destination, particularly for industrial logistics and residential markets.

Germany retains its attraction as a prime investment destination, holding the second spot in 2024, despite a slight dip in preference from the previous year. Notably, it stands shoulder-to-shoulder with the United Kingdom in terms of preference among European investors.

The industrial/logistics and residential sectors stand out as preferred avenues for investment, particularly in Berlin and Munich, which feature prominently in the top ten preferred city and sector combinations. German investors exhibit a robust commitment to real estate, with an average allocation of 14.2%, surpassing all their European counterparts at 11.3%.

France maintains its position among the top three European investment destinations, albeit sliding two spots from the previous year. Residential and industrial/logistics sectors capture investor interest in France, with Paris' industrial logistics market retaining prominence despite the city having a slight decline in representation in the sector/city preferences this year.

The Netherlands holds steady in fourth place, although it garners less attention from non-European investors. The Dutch industrial/logistics sector maintains traction, featuring in the top ten country/sector combinations, alongside Amsterdam's industrial/logistics market.

Emerging as hotspots, Spain and Italy display a significant uptick in investor interest.

Madrid and Milan lead the charge in industrial/logistics markets for their respective countries, reflecting a substantial surge in preference compared to the previous year.

Investor interest in the Nordic countries sees a notable increase, with Sweden joining Denmark and Finland in the top ten preferred locations to invest in 2024. Despite a slightly lower average allocation to real estate among Nordic investors, the region's industrial/logistics market emerges as a preferred choice, emphasising sustainability and responsible investments.

In addition to geographical preferences, environmental consciousness plays a pivotal role in Nordic investment decisions. With an overwhelming majority advocating for net-zero carbon commitments and socially responsible investments at 88% and 100% respectively, the region sets a high standard for sustainability practices, outpacing global trends significantly.

In conclusion, the investment intentions for 2024 paint a nuanced portrait of Europe's real estate landscape. Amidst shifting preferences and emerging trends, the continent remains a beacon of opportunity for investors, driven by evolving dynamics and a persistent commitment to responsible investment practices. As Investors and stakeholders navigate this dynamic terrain, strategic insights and forward-thinking approaches will continue to shape the future of real estate investment across Europe and beyond.

To continue reading more, visit our dedicated page for the Investment Intentions Survey 2024.