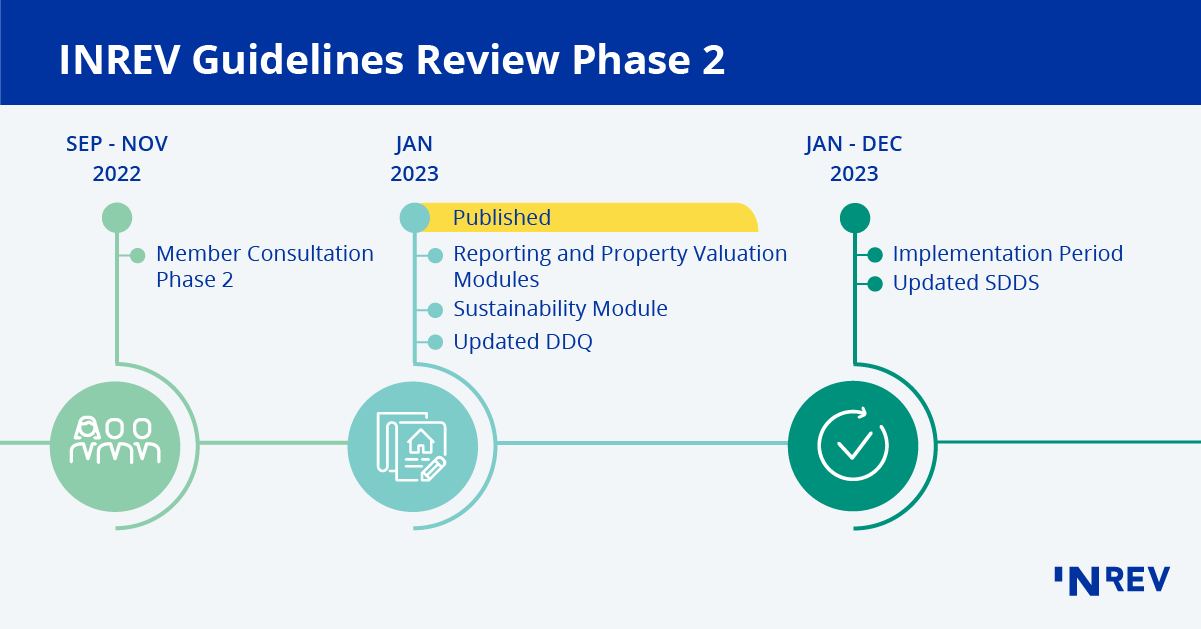

Phase 2: Consultation period closed. New modules to be delivered in January 2023

During this seven-week consultation between 21 September and 8 November 2022, feedback was invited from members on the new Sustainability module, the proposed changes to the Reporting and Property Valuation modules and an update to the DDQ.

Transition period

The final guidelines will be released in January 2023 and will be followed by a transition period. Investment managers and the governing body of the respective vehicle should assess and implement any organisational or reporting changes triggered by adoption of these guidelines during the period up to 31 December 2023. The guidelines will be applicable for reporting periods ending on or after 1 January 2024. Earlier adoption is encouraged. Many of the guidelines reflect current industry practice and regulatory reporting which should enable partial or full adoption and compliance with the modules as soon as possible.

The consultation papers can be downloaded at the end of this page.

About the Sustainability module

This stand-alone Sustainability module provides a generic framework for real estate investment vehicles to appropriately consider ESG goals, alongside other business objectives, as part of their overall strategy development. As well as guiding users to implement ESG best practices into their day-to-day operations, the module also references a set of reporting requirements and recommendations as part of the INREV Reporting module, which promote transparency and a degree of standardisation across the industry from the point of view of investor reporting on ESG matters.

In the development of the module many regulatory and business frameworks which aim to promote a more sustainable investment approach were considered to ensure the best possible alignment.

About the Property Valuation module

This module has been updated to include more focus on governance; have a better oversight of the valuation process; and increase transparency of the sustainability inputs.

What has changed?

The revised guidelines are now assembled under the principles of the Governance module. They include enhanced best practices for the conduct of the property valuation process, its oversight and governance. In addition, new guidelines related to the disclosure of sustainability inputs when determining market value were developed to increase transparency over the potential impact of sustainability factors on valuation outcomes.

About the Reporting module

The Reporting module has been updated to include asset-level disclosures in addition to vehicle level reporting, and an enhanced set of sustainability reporting guidelines and disclosures.

What has changed?The revised guidelines include a set of new sustainability reporting guidelines complemented by required and recommended ESG KPIs. These are cross referenced in the Sustainability module. The ESG KPIs will be included in a new standardised reporting template for ESG data and metrics which will be integrated into the SDDS in 2023.

About the Due Diligence Questionnaire (DDQ)The INREV DDQ has been updated to expand the focus on ESG, to integrate the current appendices into the main questionnaire, and to reflect latest changes made to the Guidelines during the review.

At the same time, new questions related to Anti-Money Laundering (AML), IT, Cyber and Physical Security at the vehicle and organisational level were included. In addition, INREV is working on a customer due diligence guidance designed to create more consistent investor disclosures to investment managers related to Know Your Customer (KYC), AML, sanctions and related requirements.

DOWNLOADS

INREV Guidelines Review Phase 2

Published on 20 Sep 2022