Library

Downloads

INREV Annual Report 2017

Published on 01 May 2018

The INREV Annual Report 2017 is out and will take you through the key highlights and achievements of 2017. View an interactive version of the report or download PDF below.

INREV gets ready for GDPR

Published on 24 Apr 2018

INREV aims to ensure that ‘personal data’ is processed in a way that is fair, lawful and transparent to our members. This overview outlines the steps that we have taken.

INREV 15th anniversary

Published on 12 Apr 2018

The INREV Annual Conference 2018 Dublin opened with a bang to celebrate INREV’s 15th anniversary. We have matured a great deal as an industry over the past 15 years and are in a good position 7 years into the recovery of this cycle. At this time, when things are positive, we need to ensure we are ready for the stormy times ahead.

Annual Conference 2018 Dublin: presentations and video

Published on 12 Apr 2018

The INREV Annual Conference 2018 was held in Dublin on 11 and 12 April under the theme 'Finding value in later-cycle investing'. To catch up an overview of the highlights, presentations, a short video and lots of images.

Michael Heise - Identifying the risk amid global growth

DownloadAlice Breheny - Europe mega trends and peak pricing

DownloadMark Roberts - North America mega trends and peak pricing

DownloadGlyn Nelson - Asia mega trends and peak pricing

DownloadMegan Walters - Global investor debate: allocations and expectations in a liquid market

DownloadClaire Penny - Embracing disruption: innovation and data in real estate

DownloadMarieke van Kamp - Highlights of the INREV Annual Conference 2018 Dublin

DownloadCapital Raising Survey 2018

Published on 10 Apr 2018

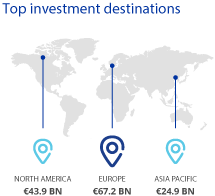

The Capital Raising Survey is a backward-looking analysis of recent capital raising activities by region, investment strategy, style, structure and other factors. This survey has been conducted annually since 2006. Since 2015, the survey has been global in scope, thanks to the involvement of ANREV and NCREIF.

INREV Due Diligence Questionnaire (DDQ) Webinar

Published on 29 Mar 2018

The INREV DDQ provides a standardised framework that helps investors achieving a high level of scrutiny when entering a due diligence process. In the last months, INREV has been updating the structure and content of the INREV Due Diligence Questionnaire to make it more global, easy and online.

Join this webinar to get an understanding of the proposed changes, to participate to the discussion and to have the opportunity to provide feedback.

The webinar is led by Jaap van der Bijl, CEO, Altera Vastgoed and chair of the Due Diligence Committee.

Erwin Stouthamer Research Grant Seminar 2018 presentations

Published on 26 Mar 2018

In memory of the late Erwin Stouthamer INREV and ANREV each awarded an academic research grant to two leading universities to carry out research on the topics of the real estate illiquidity premium and currency risk. During the seminar Professor Marc Francke from the University of Amsterdam presented highlights of the Real Estate Illiquidity Premiums study, and Nick Mansley from Cambridge University presented findings on the Impact of Currency Risk on the Performance of Asia Pacific non-listed real estate funds.

Tax Briefing 2018

Published on 20 Feb 2018

Understanding Real Estate Illiquidity Premiums Better 2018

Published on 20 Feb 2018

This research grant was awarded in memory of the late Erwin Stouthamer who served on the INREV Management Board.

A Second Look at Performance Persistence Among Core Open End European Real Estate Funds 2018

Published on 13 Feb 2018